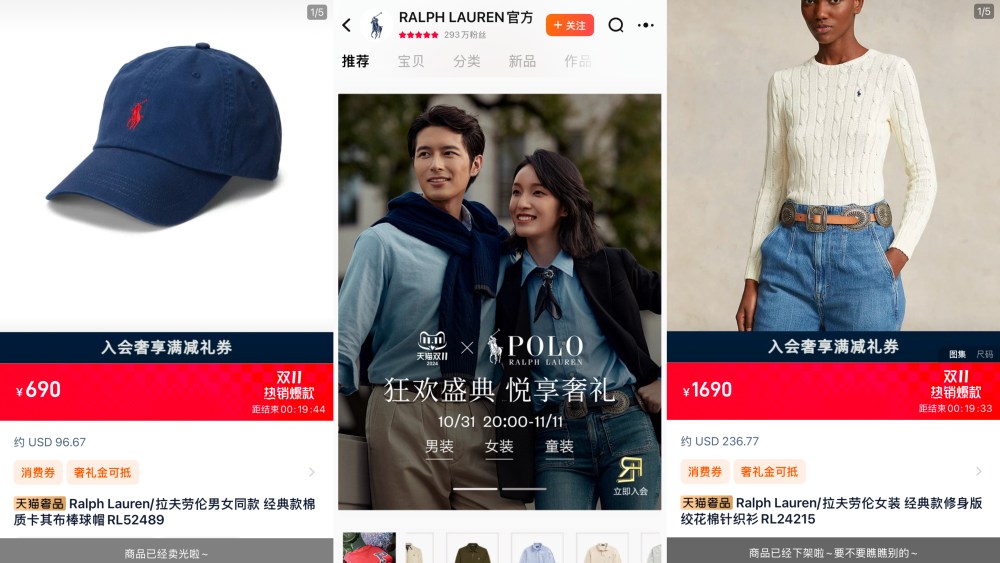

LONDON — Ralph Lauren has been caught in a misinformation bind in China.

Several local media outlets, namely Beijing Business Today, an influential state-run entity, said the brand reportedly suffered from a 95 percent order cancellation rate during this year’s Singles’ Day online shopping bonanza.

Alibaba quickly struck down the reports.

You May Also Like

According to a WeChat post by Li Pi, a member of the Tmall public relations team, seen by WWD, Ralph Lauren’s Singles’ Day performance was “very good.”

“The brand actively participated in all of Tmall’s Singles’ Day marketing activities from the very beginning. It brought the brand a very good turnover, reaching a double-digit growth year-on-year,” he added.

Local media said Ralph Lauren’s gross merchandise volume during the Singles’ Day sale period surpassed 1.6 billion renminbi, or $222 million. Neither Alibaba nor Ralph Lauren verified that number.

This year’s Singles’ Day was the longest to date, beginning in mid-October and ending Nov. 11. During the Singles’ Day period, shoppers could enjoy promotions such as 50 renminbi off a total of 300 renminbi spent on Taobao or 400 renminbi off a total of 5,000 renminbi spent for Taobao VIP users across different retailers.

Beijing Business Today claimed that many VIP users took advantage of the discount mechanism and targeted brands like Ralph Lauren, which made it easy to “put together a clean order with a few polo shirts.” It helped that Lauren’s official online store had speedy order cancellation and return policies.

It’s not an uncommon practice among China’s value-driven shoppers, especially under the current economic outlook. Other brands including Uniqlo, Burberry, Valentino and other high-grossing Chinese retailers have to deal with the same problem of shoppers taking advantage of the discounts.

While it disrupts the brands’ logistics systems, causing some items to be listed as sold out, it generates little cost, as the refund often takes place right after payment. For example, more than 20,000 people added a 1,250 renminbi Ralph Lauren knit sweater to their shopping cart, but the item only had 52 post-purchase reviews.

Most brands embrace the mechanism.

According to Jacob Cooke, chief executive officer at digital marketing firm WPIC, Ralph Lauren’s rationale for participating in this Tmall high-value coupon was to increase exposure, and sales “without ceding margin and spending their own brand marketing dollars.”

“They likely didn’t anticipate that their products were priced in such a way that customers would use their products to meet the threshold for the high-value coupon. This has created some nuisance for Ralph Lauren, but since most of these ‘returns’ happen instantly, the operational impact is somewhat muted,” added Cooke.

Moreover, the promotion drove more Tmall users to the Ralph Lauren membership program, which was a condition of the coupon. The brand has almost 3 million followers on Tmall.

“Despite stories like this, we still think the festival showed strong GMV growth excluding returns. With record-level platform subsidies and generous membership programs like Alibaba’s 88VIP, consumers actually showed a preference for premium branded goods during this year’s festival, pivoting from a recent trend of white label goods being more popular,” Cooke explained.

In Ralph Lauren’s 2024 fiscal second quarter, Asia was the fastest-growing region, up 9 percent to $380 million, with China up low-teens on a reported and constant currency basis. Digital commerce in the region, meanwhile, logged a 19 percent increase.

According to Alibaba, this year’s Singles’ Day recorded a “robust growth” in GMV and “a record number of active buyers.” Alibaba highlighted Apple, Nike, the Chinese white wine brand Wuliangye and a cohort of Chinese home appliance companies, including Xiaomi, Midea, and Haier among the 45 labels that surpassed 1 billion renminbi, or $138.2 million, in GMV.

Based on third-party data from Syntun, taking into consideration the additional ten days of the promotional period, total Singles’ Day sales across major e-commerce platforms, including Taobao, JD.com, and Pinduoduo, reached 144.18 billion renminbi, or $19.9 billion, registering a 20.1 percent increase year-over-year. Livestreaming sales from Douyin, Kuaishou, and Tmall livestream reached 332.5 billion renminbi, or $45.9 billion, a 54.6 percent jump compared to last year. Taobao remains the largest Singles’ Day player, closely followed by JD.com and Pinduoduo.

Ralph Lauren declined to comment.