For the longest time, the U.S. has largely kept the Eurocentric motorsport Formula 1 at arm’s length. The last American Formula 1 driver was Alexander Rossi’s brief stint in 2015; the only two U.S. wins are Italian-born American Mario Andretti in 1968 for Lotus and American-born Phil Hill in 1961 for Ferrari.

Since Formula 1’s ownership was bought by Colorado-based Liberty Media Corporation in 2016, the sport has gained exponential popularity growth among a younger and more globalized audience. The resurgence of interest has been thanks to its mass visibility on social media and the Netflix docudrama “Drive to Survive” — now going into its sixth season, sources told WWD that the series is expected to return in the first quarter of 2024.

Unlike many sports, most Formula 1 fans do not attend its 23 in-person races; Salesforce reported that only 1 percent of fans can attend. To that end, fans’ engagement in the sport mainly lies with other avenues such as “television, mobile, watch parties, live content, driver stat stacks and replays”; emphasizing the importance of maintaining a relevant digital Formula 1 experience.

The streaming giant released a report at the end of 2023 titled, “What We Watched: A Netflix Engagement Report,” and found that viewers watched about 90.2 million hours of the show’s fifth season during a six-month watch period from January to June. And the biggest growth in Formula 1’s demographics is women — although this demographic remains an underappreciated and untapped segment, the tides are slowly changing.

Salesforce data reported that a third of Formula 1’s 500 million fans are new from the last four years, with 41 percent of the 500 million fans being women. The company reports that the Millennial demographic powers 77 percent of Formula 1’s audience growth. Moreover, ESPN’s audience of women viewers made up 28 percent of the 2022 F1 season.

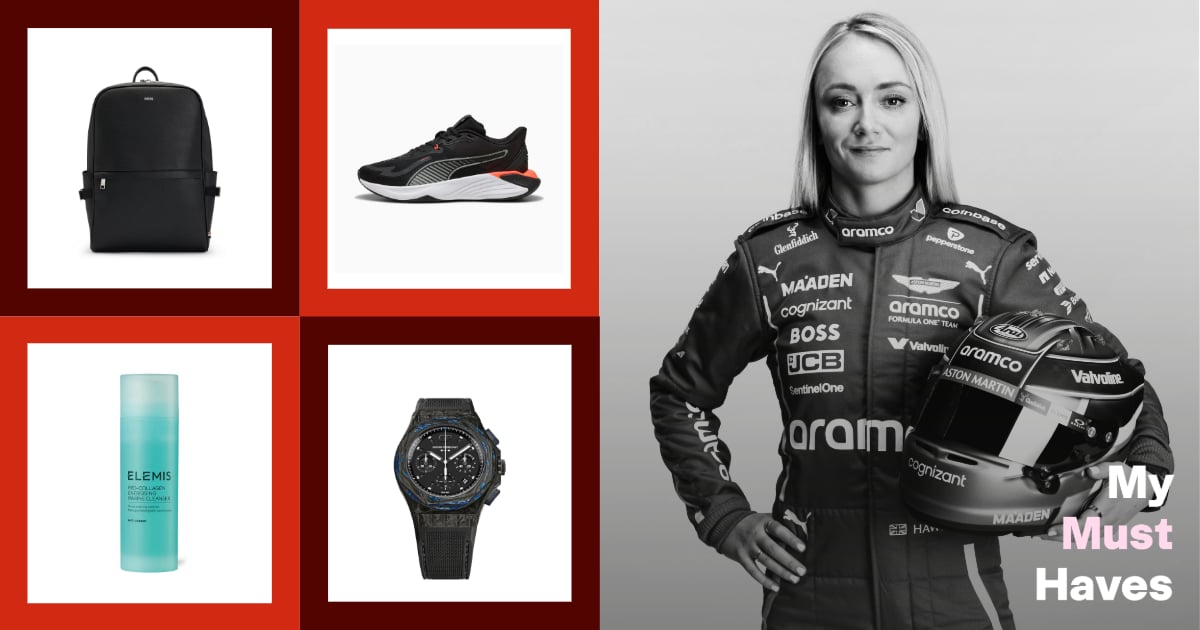

After multiple unsuccessful attempts at bringing women drivers into the fold, F1 Academy, under the helm of managing director and former decorated Scottish racer Susie Wolff, will have all 10 Formula 1 teams each supporting a driver and have the team’s livery on their car. The final five drivers will be supported by other partners.

The addition of the Las Vegas Grand Prix in November marks the third American race on the calendar, alongside Miami and Austin. Notably, the U.S. currently has the most races out of any other country; this shift marks the sport’s intention to capture an engaged and younger audience into 2024 and beyond.

If there was any lingering doubt about the sport’s popularity, the numbers don’t lie. ESPN reported that the 2023 season was the second most-viewed F1 season ever on U.S. television, with an average of 1.11 million viewers (doubling from 554,000 in 2018) per each of the 22 races.

It’s no coincidence that consulting firm McKinsey purchased QuantumBlack back in 2015; the now-artificial arm of McKinsey proved itself in Formula 1 where data and analytics reign supreme. In 2023, QuantumBlack helped set a new Guinness World Record within Formula E, the electric-powered equivalent.

Mikaela Kostaras, a prominent Formula 1 content creator @SheLovesF1 who intersects motorsports with fashion and pop culture, said that “it’s becoming clear that Formula 1 wants to capitalize on the American demographic, which is now more engaged than ever before.”

She further points to the University of Georgia’s Selig Center for Economic Growth’s annual “Multicultural Economy Report” noting America’s total buying power of $18.5 trillion in 2021. “By offering more races in the U.S., Formula 1 has tripled their potential income from fans attending races and purchasing merchandise. Vegas was the perfect opportunity for brands to use that to their advantage and capture an audience of hardcore fans, casual viewers and new spectators alike.”

Moreover, Kostaras has seen firsthand more women attending races in the past two seasons than in previous years, and more female content creators engaging with the sport on social media platforms such as TikTok, YouTube and Instagram.

India Roby, Nylon’s fashion writer notable for spearheading the publication’s Formula 1 coverage, said that the addition of the third American race on the calendar is “pushing the sport into America beyond the ‘Drive to Survive’ show. Formula 1 is trying to make it a household sport similar to football or basketball.”

Like many inaugural sporting events, the kinks of the Las Vegas race still need to be worked out. While the hype around the event was initially hampered by inflated ticket and accommodation pricing, many made the trip out as last-minute attendees after prices dropped in October; Formula 1 reported that the weekend brought 315,000 people to Sin City.

Additionally, the timing of the race being at 1 a.m. EST was less than ideal for the East Coast fans, but ESPN still reported figures of 1.3 million viewers — making it the sixth largest overall broadcast on ESPN for the 2023 season. Kostaras pointed out that the timing’s decision was made to “most likely get eyes from European and Asian viewers waking up early on Sunday morning to tune in.”

Moreover, the hospitality industry also received a massive boost in occupancy thanks to the race, as opposed to typical empty rooms the weekend before Thanksgiving. According to Las Vegas Locally, a Vegas news blog, Wynn casino dealers split $700,000 in tips ($2,000 per dealer and five times what they typically earn) on the Saturday race day.

“Las Vegas is known as the entertainment capital of the world and historically puts on the most spectacular of shows, and that’s exactly what the Grand Prix delivered — both on and off track,” said Kostaras. “This race wasn’t trying to be like Monaco, Austin or any other Grand Prix location.”

Roby echos this sentiment, viewing that the sheer number of events and brand activations events happened for brand awareness and their desire to be associated with the sport’s growing hype. She further points to Las Vegas’ notorious party atmosphere as a ROI for brands shelling out top dollar to create the ultimate experience.

The once-niche motorsport has also created a fanbase unlike any other with people willing to buy up any Formula 1 collaboration merchandise they can get their hands on. Notable fans of the sport include Rihanna, A$AP Rocky, Tom Holland, Brad Pitt, David Beckham and family, Shaq, Kylie Minogue, Patrick Demsey, Lupita Nyong’o, Justin Bieber, Cara Delevingne, Martin Garrix, Simone Ashley, Paris Hilton and Gordon Ramsey and family.

Toni Cowan-Brown, a tech and F1 commentator, was intrigued to see the weekend’s “wave of repeat Formula 1 celebrity attendees who are starting to feel like the sports ambassadors” and suspects this won’t be the last time they attend a race weekend.

Kate Byrne and Nicole Sievers, cofounders and podcast hosts of @TwoGirls1Formula, noted that “Formula 1 has always been part of the cultural conversation. Drivers are becoming more than employees of their teams. They’re influential with fashion lines, profiles in fashion magazines, and appearances at fashion weeks and events such as the Met Gala. The American market loves celebrity moments and will pay attention to marketing that features their favorite stars.”

To further add to the weekend’s hype, Netflix hosted its first-ever livestream sports event with Formula 1 and golf pros from docudrama, “Full Swing.” Teams of Carlos Sainz and Justin Thomas, Lando Norris and Rickie Fowler, Alex Albon and Max Homa and Pierre Gasly and Tony Finau competed against each other in the first Netflix Cup.

Despite the event receiving mixed reviews and reactions from fans and industry insiders alike, undoubtedly, this won’t be the last livestream Netflix puts on in the future; Bloomberg reported that sponsors including T-Mobile and Nespresso paid $2 million to be included in the special.

Byrne and Sievers said that the entire race weekend’s experience was a learning curve. “From the race to the Netflix Cup, the first time of anything is mostly about making mistakes and figuring out how to adapt for the future. Was the Netflix Cup chaotic? Of course. Does it have the potential to be something great? Absolutely.”

Cowan-Brown foresees that the intersection within fashion and retail space will only grow moving forward. “The baseline of what is deemed interesting will rise offering fans more creative collaborations and activations, but only will stand the test of time by creating quality and thoughtful partnerships.”