Is Gap Inc. getting reenergized?

Real signs of a recovery in the works emerged Thursday when the San Francisco-based Gap Inc. reported a profitable first quarter for 2024, reversing last year’s loss, and cited comparable sales gains across all four of its brands: Old Navy, Gap, Banana Republic and Athleta.

“We are really pleased with our quarterly performance,” Richard Dickson, Gap Inc. president and chief executive officer, told WWD, adding that the quarter “exceeded expectations and was the fifth consecutive quarter where we grew market share.”

Asked when was the last time Gap Inc. reported quarterly comparable sales gains for all four of its brands, Dickson replied: “The truth is, we can’t remember.”

For the quarter ended May 4, net income came to $158 million, compared to a net loss of $18 million in the year-ago quarter.

Operating income was $205 million, compared to an operating loss of $10 million in the year-ago period.

Net sales of $3.4 billion were up 3 percent compared to last year. Comparable sales rose 3 percent.

Dickson said the Gap Inc. playbook he introduced after becoming CEO in August 2023 “is really coming together. We are starting to see a reinvigoration of the brands through better products, better marketing, better storytelling and excellence in execution.”

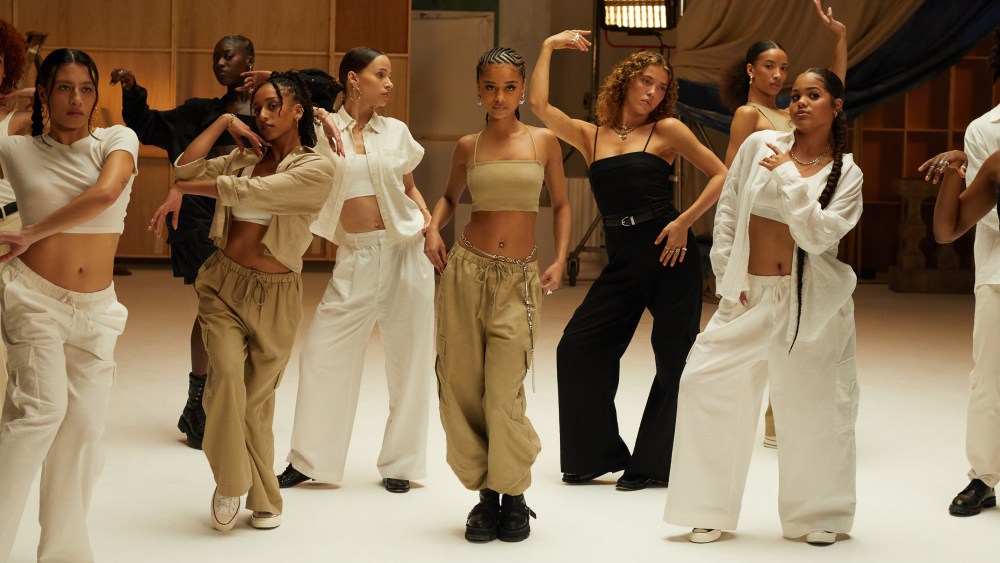

Discussing some first-quarter selling highlights, Dickson said that at the Gap brand, “our ‘Linen Moves’ campaign has been incredibly well-received. Linen sales are up double digits. We’re adding colors and styles. We believe linen will be an important segment of our business as we move forward.”

Old Navy, he said, saw a lift in women’s, particularly with woven tops, though he added, “across the board, we’re seeing better product overall.”

Banana Republic, Dickson said, saw “nice improvement” from previous quarters through a “reenforcement” of classic styles and emphasizing the “finest fabrics,” particularly leather and suede.

Athleta’s gain, Dickson said, was driven by new product innovations, core bottoms and limited-edition drops.

Asked about industry-wide concerns over consumers spending less on discretionary items and more on travel and experiences, Dickson replied, “We don’t see much of a change in the consumer sentiment from where it was in 2023.” He said the industry is operating amid “a backdrop of uncertainty and a little choppy waters,” though he added that “in this industry there are always winners, regardless of the geopolitical and macroeconomic climate.” The turnaround work being done at Gap Inc., Dickson said, is “really resonating with our consumer.”

Still, part of Gap Inc.’s gains could be attributed to weak comparisons from a year ago. “We are lapping challenging metrics,” Dickson acknowledged. “That being said, in order to reverse any metrics, it takes diligence and discipline in the execution of strategies.”

He said the overall strategy at Gap Inc. revolves around four priorities, citing “financial and operational rigor, reinvigorating the brands, strengthening our platform and energizing the Gap Inc. culture.”

“We are really starting to see the work we’re doing show up in the metrics, but we are just beginning. We still have a lot of work to do. We’ve got momentum. We delivered strong results, giving us the confidence to raise the guidance for the year.”

Despite what the company described as a “continued uncertain consumer and macro environment,” it is increasing its outlook for fiscal 2024, based on the first quarter’s higher net sales and “meaningfully” higher operating income growth compared to its prior expectations. The company now expects sales to be up slightly, versus its previous forecast for roughly flat sales. Last year, Gap Inc. generated $14.9 billion in sales.

The company sees operating income increasing in the mid-40 percent range, while previously it was anticipated increasing in the low to mid-teens. Gross margin this year is now seen increasing by at least 150 basis points, whereas the previous forecast was for a 50 point increase.

In after-market trading, Gap Inc.’s stock price soared 20 percent to $27.15 with Wall Street highly impressed by the Q1 results and the revised forecast.

For the second quarter of this year, sales are expected to be up low-single digits. In the second quarter of 2023, Gap Inc. reported $3.55 billion in sales. Gross margin is seen increasing by 300 basis points. In the 2023 second quarter, gross margin stood at 37.6 percent.

At Old Navy, first quarter net sales of $1.9 billion were up 5 percent compared to last year. Comparable sales were up 3 percent. “This represents the third consecutive quarter of positive comparable sales at the brand as its continued focus on operational rigor is beginning to build improved consistency in performance,” the company indicated in its prepared statement Thursday.

At Gap, first-quarter net sales of $689 million were flat compared to last year. Comparable sales were up 3 percent. “This represents the second consecutive quarter of positive comparable sales at the brand. Gap’s performance was primarily driven by strong marketing and product execution centered around its Linen Moves campaign,” the company stated.

At Banana Republic, net sales of $440 million were up 2 percent compared to last year. Comparable sales rose 1 percent. According to the company, Banana Republic continued focus on “fixing the fundamentals” drove sequential improvement in performance compared to the fourth quarter.

At Athleta, first-quarter net sales of $329 million were up 2 percent compared to last year. Comparable sales rose 5 percent. “Sales trends at the brand improved meaningfully versus the prior quarter as the customer responded well to the new product, brand expression, and activations,” Gap Inc. indicated. The company expects net sales in the second quarter to be challenged as the brand laps last year’s quarter of heavy discounting.

In other statistics released by Gap Inc., store sales increased 3 percent in the first quarter. The company ended the quarter with 3,571 stores in more than 40 countries, of which 2,554 were company operated.

Online sales increased 5 percent compared to last year and represented 38 percent of total net sales.

Gross margin of 41.2 percent increased 410 basis points above last year’s reported gross margin and increased 400 basis points versus last year’s adjusted gross margin, which excludes $4 million in restructuring costs.