PARIS — Signaling continued momentum in premium beauty, Puig reported revenues grew 9.6 percent in the first half to 2.2 billion euros, with like-for-like growth amounting to 8.5 percent.

Signaling continued momentum in premium beauty, Puig reported revenues grew 9.6 percent in the first half to 2.2 billion euros, with like-for-like growth amounting to 8.5 percent.

In the six months ended June 30, adjusted net profit increased 4.8 percent to 238 million euros.

Filing its first results since going public last May, the Spanish beauty and fashion group trumpeted that its market share in selective fragrances gained 60 basis points to 11.3 percent in value terms, compared to June 2023.

Related Articles

In a presentation to analysts following the release of the results, Puig chairman and CEO Marc Puig maintained that the company’s growth projections unveiled at its IPO earlier this year remain the same. The company expects 6 to 7 percent growth annually through 2027.

Still, shares fell sharply on the Madrid stock exchange following the news, plunging 12.3 percent in midday trading.

The company remains optimistic on its growth prospects despite relatively flat sales in the makeup category, particularly due to the success of the Jean Paul Gaultier fragrance brand and the entrance into the prestige skin care market following the acquisition of Dr. Barbara Sturm to its portfolio in January.

Its skin care segment advanced 25.2 percent on a reported basis, while makeup sales dropped 1.8 percent.

“While our fragrance and fashion business remains our largest segment, we further diversified into skin care — the fastest-growing business segment during the first half — with a strong organic growth component and a strategic brand acquisition,” Marc Puig said in a statement, referring to the deal in January that added Dr. Barbara Sturm to its portfolio.

The CEO also cited the Uriage skin care brand as having “double-digit sales” growth in the drugstore category.

The decline in the makeup category was largely placed at the feet of Christian Louboutin’s weakness in China.

The brand is one of Puig’s few licensing deals, Marc Puig noted, having acquired the name in 2018. It has historically greater exposure in China than other brands in the company’s portfolio.

“We have seen in [the first half] the performance in that market has been disappointing, and that’s one of the reasons why our overall makeup category has shown the small regression,” Marc Puig said.

Charlotte Tilbury makeup was a mixed bag, with it remaining the number-one prestige makeup brand in the U.K and hitting number two in the U.S. in terms of sales, supported by the brand’s entry into Ulta.

Tilbury had several sell outs in these key markets, but it also has wide exposure across the APAC region which impacted its overall performance. Coupled with destocking at some Asian retailers resulted in “overall flat net revenue performance” for the Charlotte Tilbury brand.

Marc Puig added that outside of the Christian Louboutin brand, the company has limited overall exposure in China, and it is seeking to shore up the rest of the APAC region. Following the opening of a subsidiary in South Korea last year, the company opened Puig India and Puig Japan in the first half to further its commitment to these geographies for the longer term.

The outlook in the region remains moderate, Marc Puig said. “We believe that Asia Pacific will continue to remain soft for the remainder of the year, in particular, due to consumption levels among Chinese customers being below expected levels,” he said. APAC is its smallest market and showed a relatively flat 0.7 percent growth on at a constant perimeter basis, with 204 million worth of sales.

Europe remains the Barcelona-based company’s largest market, and it delivered 10.5 percent growth at constant perimeter basis to 1.15 billion euros. The Americas were up 7 percent at a constant perimeter basis, with the U.S. in particular showing growth “well in the double digits,” to 814 million euros. Latin America tempered the region’s growth, particularly due to wild currency fluctuations in Argentina.

In Europe, it opened a new headquarters in London and renovated its European hub in Brussels, as well as opened its splashy new Barcelona home.

Fragrances and fashion, billed as Puig’s largest and most profitable business segment, gained 10.7 percent to 1.6 billion euros, representing 73 percent of total revenues.

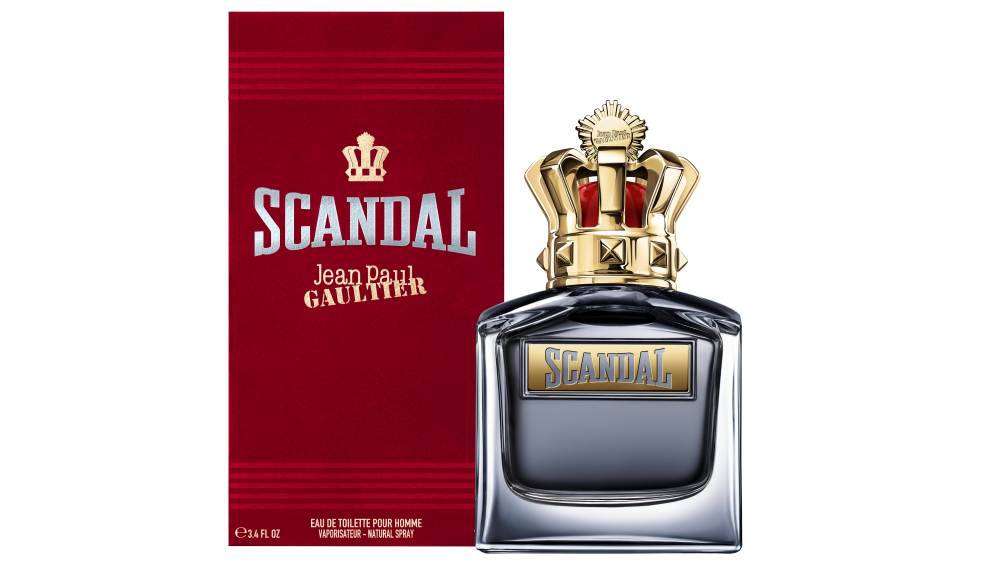

Puig highlighted the “exceptional performance” of Jean Paul Gaultier, which joined its Carolina Herrera and Rabanne brands in the top 10 ranking fragrances worldwide. It credited the successful launch of Gaultier’s La Belle, Le Beau and Scandale Absolu scents.

The recent success of the more than 40-year-old brand was largely credited to its popularity on TikTok, Marc Puig said during the presentation.

“TikTok has been one of the channels where the new generation has been discovering and building an emotional connection with this brand that is so rich in heritage,” he said, crediting the brand’s ethos of inclusivity for its popularity especially among tween boys.

“We have also seen the entrance of a new consumer, much younger, particularly in the male, 12- to 15-year-old [demographic] that have started to participate in this category in ways that we had not seen necessarily the past,” he said.

In the second half, the company will launch Rabanne the Million Gold line with Gigi Hadid as the face of the new brand. Jean Paul Gaultier will also launch two additional fragrances in the second half.

“Within those lines, we keep bringing new shifts, new shapes, new different versions of the of the fragrance and overall, that’s a very solid proposition because there’s no cannibalization of all lines. It is a whole line that is growing,” he added.