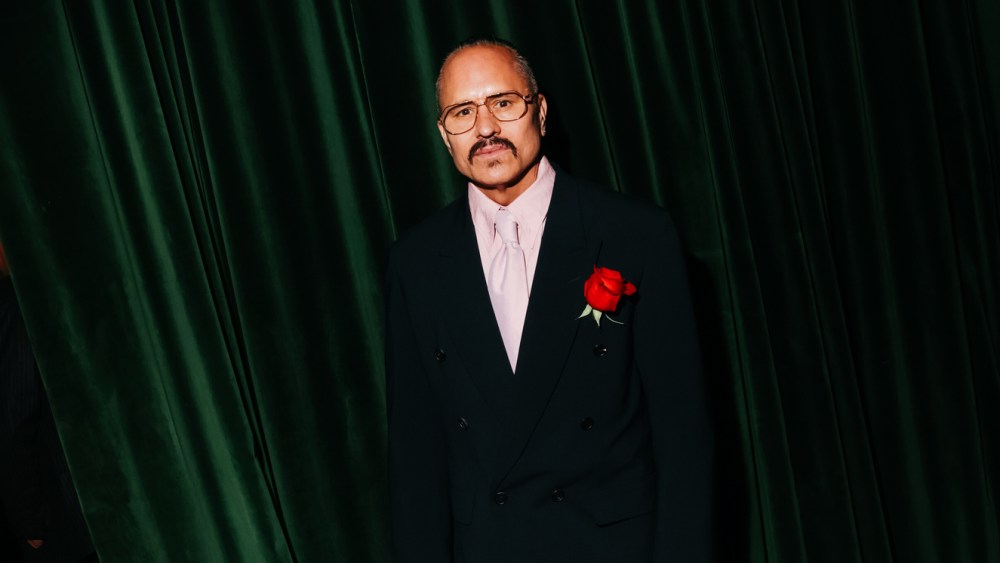

Willy Chavarria has secured a strategic minority investment from Chalhoub Group, WWD has learned, marking a significant milestone for the designer whose culturally conscious menswear has resonated far beyond New York.

The deal brings together the Middle East‘s preeminent luxury retailer, a 70-year-old family business that operates more than 950 stores across the region, with FAE Fashion Ventures, the brand-building firm founded by music industry veteran Sarah Stennett that first invested in Chavarria in spring 2024. The partnership signals both the rising prominence of culturally relevant fashion brands and the evolution of regional luxury groups from retail and distribution partners to active brand builders.

“In choosing partners for the Willy brand, David [Ramirez, the brand’s chief operating officer] and I sought the highest levels of business expertise along with an understanding of our brand purpose,” Chavarria said in an email to WWD. “Both FAE Group and Chalhoub embody these qualities. Their experience in luxury, their integrity, and their respect for culture make them the perfect partners. Together, we’re building a global powerhouse that connects with people where they are.”

You May Also Like

The investment, which is in a venture capital range — under $5 million — comes as Chavarria rides a wave of momentum that includes receiving the WWD Honors Men’s Designer of the Year award later this month and his increasingly prominent Paris Fashion Week presentations. Since FAE’s initial backing 18 months ago, the brand has more than tripled its wholesale doors and landed collaborations with Adidas, Don Julio and Tinder.

“Willy Chavarria is a designer who represents the evolving face of luxury — rooted in culture, identity, and community,” Zahra Kassim-Lakha, Chalhoub Group’s chief investment officer, told WWD. “Our partnership is grounded in a shared ambition to support brands with strong values and distinctive voices.”

As Chavarria enters this new chapter, he benefits from having complementary investors with different strengths, from FAE’s creative industry expertise and early-stage brand building to Chalhoub’s operational know-how and regional expansion capabilities. Also joining the partnership is Webster Capital and its founder Tony Olson.

For Chalhoub Group, the deal represents the latest iteration of an investment strategy that has evolved significantly over the past decade. Kassim-Lakha, who is driving the group’s venture capital efforts, said the company, which employs more than 16,000 people across eight countries in the Middle East, is looking beyond its traditional retail and distribution model to direct brand ownership and development.

“The first generation of investments for the group was really about creating distribution access in different parts of the world,” she explained. “The layer I’m coming in on now prioritizes the importance of product brands that we can potentially help with scale-up, retail and distribution, not only in the Middle East, but in other parts of the world when they’re ready.”

Kassim-Lakha emphasized that what sets Chalhoub apart is its operational support and long-term partnership approach, rather than aggressive consolidation.

“Top of the list for our group is the idea of long-term partnership,” she said. “We really want those founders and their teams to continue on their journey, and we will be their partner.”

That philosophy appears to align well with Stennett’s approach at FAE, which she modeled after the music industry’s artist development system — a contrast to fashion’s traditional investment patterns.

“I come from the music business,” Stennett told WWD. “I found that in the fashion industry, unlike in the music space where people invest in really early talent to create generational artists, there was no early investments in fashion creative talent.”

FAE’s first investment was Casablanca Paris, which it successfully exited before investing in Willy Chavarria. A pivotal early move after investing was moving Chavarria’s shows from New York to Paris. “We knew pretty quickly that he’d saturated New York,” Stennett said. “We felt that he was, without doubt, somebody that can compete on a global stage.”

The Paris gambit has paid off. Chavarria’s shows have become must-see events on the calendar, drawing industry heavyweights. His aesthetic of oversized silhouettes, workwear-inspired tailoring and socially conscious narratives about immigration, identity and community found a receptive global audience.

“When we started talking to him about a year-and-a-half ago, you could sense the collection was starting to come together,” Kassim-Lakha recalled. “The way he speaks cultural relevance to a younger generation, but actually, frankly, to all generations in a very culturally sensitive way, with an incredible humanity.”

Both investors emphasized Chavarria’s authenticity and lack of ego as key factors in their decision to back him. “He’s larger than life because of his humanity,” Kassim-Lakha said. “There’s no ego.”

Stennett pointed to Chavarria’s four decades of industry experience — despite launching his own brand just 10 years ago — as evidence of his operational maturity. “It’s a small, young company, but he has four decades of experience,” she said. “That was another big checkmark for us.”

The brand’s high-profile collaborations have helped accelerate growth. The Tinder partnership, in particular, demonstrated his ability to work with unconventional partners in ways that enhance rather than dilute the brand.

“On first hearing about Tinder, it’s very easy in a certain luxury space to think, ‘I don’t know whether that’s going to work’,” Stennett admitted. “But the brilliance of Willy and the team around him — it’s just thinking ‘how can this be executed differently?’ That’s all Willy’s genius of knowing what’s going to work for the brand.”

Looking ahead, both investors emphasized a measured approach to expansion. The immediate priority, Stennett said, is building the right team and infrastructure to support sustainable growth.

“Our first priority has been for the executive team to build a foundation and infrastructure that is ready to support growth,” she said. “That means recruiting the right team, putting the right people in the right seats.”

A flagship is in the plans as well, with New York the likely location. “We think New York is home,” Stennett said, though she noted that Chavarria also has strong connections to Paris, Madrid and Mexico City. “I think the foundational route starts in New York and will grow.”

For the Middle East market specifically, Kassim-Lakha said the approach will be gradual. “The Adidas collaboration has increased brand awareness. But building a full presence for the brand’s higher-end offerings will take time,” she said.

“The status of the Middle East is one of the only sustainably growing markets for the foreseeable future,” Kassim-Lakha noted, citing the region’s ongoing infrastructure development and growing luxury consumer base as offering a lot of potential.

“It’s also important for him to be very well-known elsewhere too,” she said, emphasizing the importance of building global brand equity before saturating any single market.

When asked how they’ll measure success, both investors pointed to longevity and stability rather than short-term revenue targets.

“The starting point for our measure of success is longevity and stability,” Stennett said. “We’re not trying to supercharge growth in a way that creates instability.”

For Chalhoub Group, it’s about deepening the relationship with the Willy Chavarria client. “When you start to analyze brand equity, it is not just what the marketing looks like, it’s not just the image, it’s not just the language,” she said. “It’s the full understanding of the real customer, the target customer,” said Kassim-Lakha.