Saks has launched the Saks Media Network, a platform for digital advertising geared to boost the retailer’s revenues and site traffic and give greater exposure and shopper insights to participating vendors.

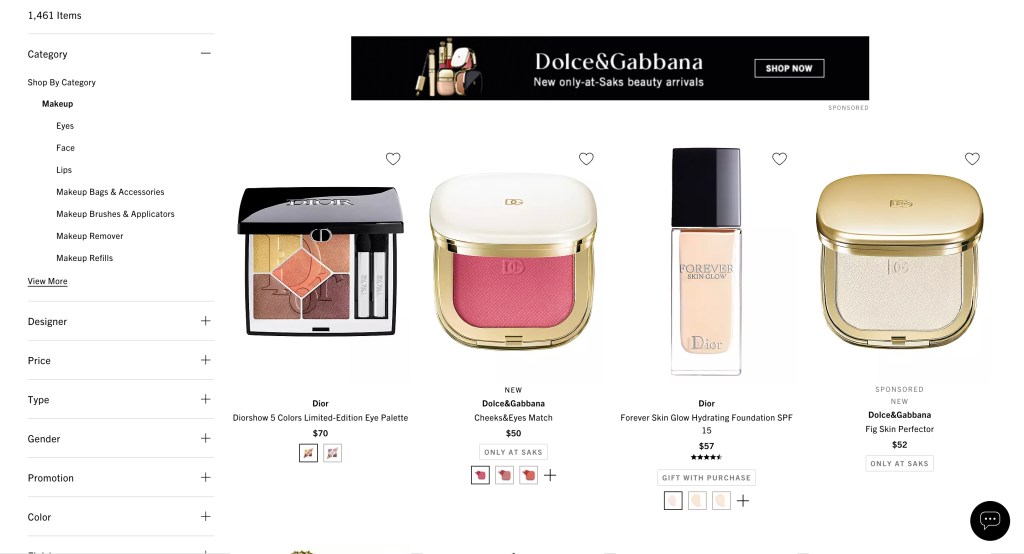

Saks officially launched its media network on Tuesday, opening it up to the industry after a two-month beta test involving just a limited number of vendors. Brands that have placed sponsored ads on the Saks Media Network so far include David Yurman, Chanel Beauty, Dolce & Gabbana Beauty and Fragrance, Akris Punto, Ramy Brook, Stuart Weitzman, Amiri, Rag & Bone, and Assouline.

“The test was where we invited a small subset of brands who we knew would be interested and had been kind of talking about it with us early on. We wanted to understand how would they perform on the site and how we could optimize campaigns before we fully launched to all of our brands,” Kristin Maa, Saks’ senior vice president, growth, told WWD.

“It’s very early days so we’re still learning, but I think this could be fairly significant in terms of what we’re able to generate,” Maa said when asked about the network’s potential for revenues. “This is also new for a lot of our partners. We’ve spent a significant amount of time with our brands, helping them to understand how the media network works and how they can best utilize it. So it still feels early.”

To date and through the testing period, “More than 30 brands have participated across all of our categories, and some have participated in multiple campaigns,” Maa said. “They’ve continued to re-up because they’re seeing success. But we’re launching new brands weekly.”

Retail media networks are a relatively new phenomena in the industry, though the number of companies undertaking them has been growing, including Ulta, Macy’s, Bloomingdale’s, Nordstrom, Tanger Outlets, and Simon Property Group’s Shop Premium Outlets. Two of the biggest are operated by Walmart and Amazon, which generates a significant amount of revenue from advertising.

Through the Saks Media Network, designer and brands place sponsored product ads and display banners on the Saks.com website and the Saks app. Saks indicated that its draws over 435 million annual visits to its online channels.

“With the launch of our Saks Media Network,” said Maa, “Saks is helping the products of its brand partners reach the right luxury customers when and where they are actively looking to purchase. The Saks Media Network is the next step in leveraging our data-driven insights and industry expertise to enhance the customer experience.” She added that there is a personalization element to the program so specific ads are targeted to specific customers.

“We haven’t in the past had the opportunity for brands to work with us on putting ads in a particular space in the [online] customer shopping journey,” such as on homepages, product pages and editorial pages, Maa said. “We’ve worked with brands in a traditional co-op capacity, on paid social media ads, or on sending emails to customers, but actually on-site is something that we’ve had limited ability to do,” until launching the media network.

Asked how brands are charged for participating in the media network, Maa said, “It’s like the way Google Ads work,” with brands setting budgets and goals for a return on the ad spend. Saks’ ad tech partner, Criteo, helps determine the cost to vendors. It’s a cost per click model.

Asked whether participating in the Saks Media Network means vendors might reduce advertising with Saks via other venues, such as paid social and catalogues, Maa replied: “Not necessarily, though it could depending on how a brand thinks about its budget. But we see brands using this as an incremental opportunity. We’ve talked to jewelry and gift brands that have said, ‘Okay, Valentine’s Day is coming up. How can we push sales right before Valentine’s Day?’ This would be something that we can help leverage. We can set up something very quickly that can have an impact in amplifying their brand and their sales during that Valentine’s Day period.”

Asked to what degree Saks sets the look of the ads in its media network, Maa replied, “We partner with the brands and have our creative team involved in what the display ads look like.” On sponsored ads, there is no Saks creative design involved, which Maa said enables Saks to start a campaign very quickly. Ads that are sponsored are clearly indicated as such, and more prominently displayed online.

“One of the things that brands love about the media network is that we’re able to give fairly robust reporting, once the campaigns are finished,” Maa said. “We are able to give them a full view of how customers are interacting, whether or not they’re buying.”

Saks.com has been dealing with a challenging macro environment for selling fashion and has reporteldy been delaying certain payments to vendors, while working to improve its liquidity position. A week ago Saks secured up to $60 million in incremental liquidity capital from a syndicate of lenders led by Pathlight and Bank of America, as WWD reported. Specifically, Saks has expanded its term loan facility with Pathlight, bringing the total borrowings under the facility to $215 million, reflecting what the company described as “low debt levels relative to the size of our business.” Saks also has the potential to access an additional $20 million in the future, once certain conditions are met.

In May 2021, Saks.com closed on a syndicated $350 million, asset-based five-year revolving credit facility arranged by Bank of America, and a $115 million senior secured term loan arranged by Pathlight. About two months before, Saks Fifth Avenue was re-engineered by its parent, HBC, with a new business model, equity partner and stronger balance sheet, splitting the Saks Fifth Avenue store fleet and Saks.com into separate companies. Insight Partners, a venture capital and private equity firm, made a $500 million minority equity investment in the Saks e-commerce business, valuing it at $2 billion at the time.

As previously reported in WWD, Macy’s Inc. has operated a media network for the past couple of years for its Macy’s and Bloomingdale’s divisions, and earlier this year appointed Michael Krans vice president, Macy’s Media Network. In 2023, Macy’s Media Network accounted for $155 million in sales, or 0.7 percent of total sales of $23.1 billion. In 2022, Macy’s Media Network generated $144 million.

Shop Premium Outlets, which is Simon Property Group’s outlet business, recently jumped on the retail media network bandwagon through a partnership with Mirakl, a retail tech firm specializing in marketplace platforms. The Shop Premium Outlets site launches targeted ads powered by artificial intelligence.

Saks, in a statement revealing its media network, said, “Saks’ strategic in-house media team leverages customized strategies to help brand partners drive business, matching their specific goals with opportunities to achieve them, supported by comprehensive reporting and insights. Saks maintains deep relationships with high value luxury consumers at scale, and the launch of the Saks Media Network brings the opportunity to engage with this customer segment to a broader set of partners.”