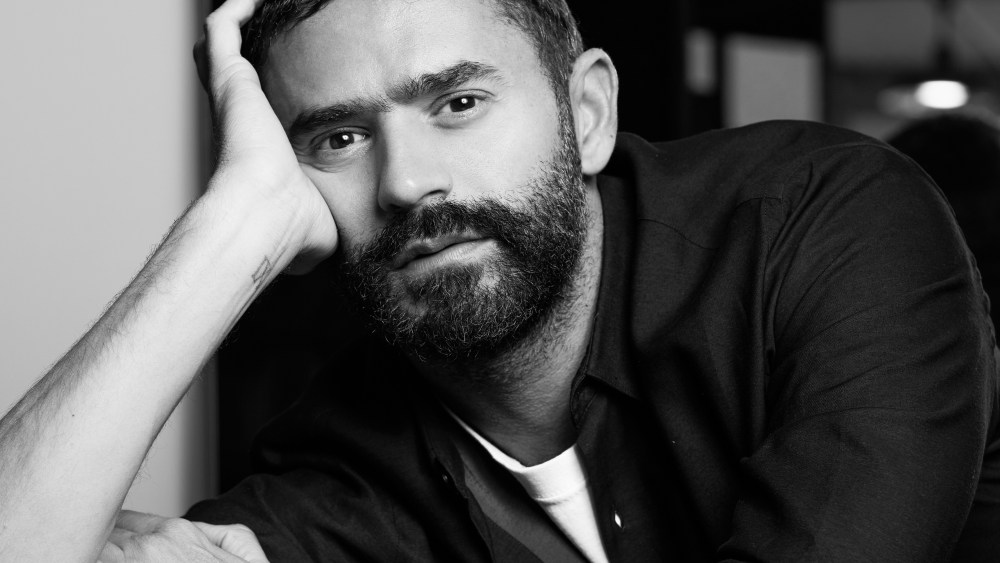

Inertia is anathema for Nicolas Hieronimus, chief executive officer of the L’Oréal Groupe.

Whether cycling 40 to 50 miles every weekend or making deals, meeting teams and traveling the world in his role overseeing the world’s largest beauty company, Hieronimus is a man whose drive to seize the future has not just cemented L’Oréal’s position in the beauty universe — it’s driven the company to new heights despite the turbulence of the macro environment he’s operating in.

Related Articles

Since ascending to the CEO suite in 2021, succeeding Jean Paul Agon who is now the company’s chairman, Hieronimus has overseen an era of rapid expansion. During his tenure, L’Oreal has acquired Youth to the People, Skin Better Science, Dr. G, Aesop, Medik8, ColorWow and, most recently, in a deal that shook the industry, Kering’s beauty properties in a 4-billion-euro transaction — the largest in L’Oréal history.

Over the past four years, L’Oréal has also signed long-term licenses with Jacquemus and Miu Miu, and taken minority stakes in Amouage, Shinehigh Innovation and Galderma, planting the company’s flag in the fast-growing dermaesthetics space. Hieronimus has launched the L’Oréal Circular Innovation Fund, the L’Oréal Climate Emergency Fund and the L’Oréal Solstice fund during his tenure, and has accelerated the activity of BOLD (Bold Opportunities for L’Oréal Development), the company’s venture fund.

All this in a post-COVID landscape roiled by geopolitical tensions and economic uncertainty. And Hieronimus, who will turn 62 in January, is just halfway into a tenure that is expected to last through his 65th birthday, when French law mandates retirement.

“In times like this, one possible reaction is inertia — what the hell is happening? I’m going to lock in everything, put sandbags around it and protect the company,” said the CEO during a wide-ranging interview in his 10th floor office suite in L’Oréal’s Clichy headquarters. Tastefully decorated in tones of cream and beige, pops of color are provided by products from each of the company’s 37 brands displayed on one wall and a series of photos by Jean-Baptiste Huynh above his desk.

“Both the culture of L’Oréal and my own philosophy is to choose the opposite,” Hieronimus continued, “to be constantly on the move, to transform ourselves, whether it’s making more acquisitions or venturing into new territories.

“It’s about seeing where all of the opportunities lie and, more than ever, seizing what is starting,” he said. “Because if you stand still, you’ll just be hit by the difficulties of the world, and that is not how you become a 116-year-old company that is still extremely dynamic.”

It’s been exactly one week since L’Oréal and Kering announced their strategic partnership encompassing the acquisition of the House of Creed, the rights to the Gucci beauty and fragrance license when its term with Coty expires and the intention to jointly explore business opportunities at the intersection of wellness, luxury and longevity. The next day L’Oréal unveiled its third-quarter earnings, with like-for-like sales increasing 4.2 percent.

While those results were a slight miss versus analyst’s expectations, today Hieronimus is relaxed and at ease, animated by a vision of beauty that is all-encompassing and ever expanding. He has been aggressive in broadening the scope of L’Oréal’s operations to position the company for the future.

In 2024, the company acquired a 10 percent stake in the medical aesthetics company Galderma, with many analysts positing that the company will increase its stake in the near to mid-term. With BOLD, it has taken stakes in adjacent categories like biotech and sustainability-oriented ventures, the deal with Kering is expected to push it further into wellness and hospitality, and L’Oréal is one of three companies in the running to acquire a 15 percent stake in the Giorgio Armani business.

“Beauty is a bit like space — it’s an expanding universe with new planets, new horizons, new energies,” said Agon. “Each CEO of L’Oréal has expanded the company’s area of performance and expertise, and I’m sure that Nicolas will do the same in the years to come.”

Hieronimus likes to point out that L’Oréal is an enterprise that has built its scale and breadth via acquisition, noting, for example, that CeraVe was a 140-million-euro brand when L’Oréal acquired it in 2017 and now has an annual turnover of over 2 billion euros (“and is the number-five skin care brand in the world,” he likes to add.)

“Our model has always been to acquire successful, complementary, local brands and make them global,” said Hieronimus. “But what’s changed is now you must be even more selective, because there are so many indie brands being created that the opportunity for acquisition is multiplied. There’s not one week when I don’t have a proposition to acquire a fast, dynamic, growing indie brand that has reached a certain potential, sees it is hard to scale on its own and is looking for a [buyer].

“But you have to be strategic,” he continued. “Brands that are built on a fad aren’t great for your portfolio. The two relatively smaller acquisitions we made this year,” he said, referring to Medik8 and ColorWow, “both have interesting technology. Their success isn’t just because they’re cool and influencers support them. It’s because the product is based on real scientific improvement and delivers.”

As for where the Kering acquisition fits into the vision? For one, it gives L’Oréal entrée to high-end niche fragrances, where it is underpenetrated, and also reinforces its position in the designer license segment, where it already excels with brands like Giorgio Armani, Yves Saint Laurent, Prada, Valentino and, most recently, Miu Miu. Bottega Veneta and Balenciaga will become part of L’Oréal’s portfolio when the deal is finalized, and Gucci, in particular, whose beauty sales under Coty are said to be under $1 billion, is thought to have significant untapped potential, despite the challenges faced by the fashion side of the business.

“There have been many discussions about the challenges that Gucci is facing, but many fashion brands have had cycles, highs and lows,” said Hieronimus. “But this is a brand with a strong DNA and soul, and I’m sure that it will explode again. And our teams understand how to capture that brand magic and transform it into actual desirable and superior products,” said Hieronimus, noting that L’Oréal has driven significant beauty businesses for Armani and YSL even when the fashion side may not have been thriving. “Gucci is incredible — the awareness and love for that brand are. Huge. It will just take a spark and our own savoir faire to make it a very big brand.”

A 38-year-veteran of L’Oréal who started as a marketing manager on Garnier has given Hieronimus a unique instinct for the next big thing in beauty, say those who know him well. “He knows how to detect the signals,” said Delphine Viguier-Hovasse, the former head of L’Oréal Paris who was named the group’s first chief innovation prospective officer in May. An engineer by training, she was hired by Hieronimus in 1997 during his Garnier days.

“That’s why he’s so good at innovation — he’s hearing the signals of his teams and communities and it helps him to build a point of view,” she said. “He knows the company deep down, and even though it’s very big, he has a personal relationship with every general manager of every country,” Viguier-Hovasse continued. “So he has a lot of information and a gigantic vocabulary of business cases. In many companies, you have a CEO who changes regularly or comes from outside of the industry. Our strength is the CEO knows our company extremely well.”

By all accounts, Hieronimus is a true product person. While at Garnier, he oversaw the creation of Fructis, while blockbuster launches like Lancôme’s La Vie Est Belle launched during his tenure as president of L’Oréal Luxe from 2011-2018.

“What really characterizes Nicolas the most is he is very balanced between right brain and left brain, between strategic and creative. That’s fundamental in our business,” said Cyril Chapuy, who succeeded Hieronimus as head of the Luxe division and overseen its expansion.

“On the strategic side, the capability he has to see the big picture on brand equity, define very clearly a brand’s territory, values and uniqueness is extremely impressive — especially considering we have 27 brands in the Luxe division,” said Chapuy. “And then the creative side, which is fundamental in beauty because you need to be obsessed by creating, bringing new ideas. He is embedded into pop culture — he loves music, art, movies —it’s a great way to exchange with him on strategy, but also pure creative ideas.”

Hieronimus loves to stay in lockstep with culture. He’ll often try to catch a concert when he’s traveling, and every summer, he curates a playlist for L’Oréal’s 90,000-plus employees. Just how plugged in is Hieronimus? It was he who suggested Dua Lipa and her song, “I’m Free,” as the anthem for Yves Saint Laurent’s Libre scent, which launched in 2019 and is now the number-two ranked fragrance brand in the world.

“You have to evolve at the speed of culture and culture moves very fast,” said Hieronimus, who noted that while everyone, including him, loves the ’80s music he grew up on, he keeps his playlist au courant by compiling a running list throughout the year of his favorite new songs.

“The role of CEO of L’Oréal is different than being the CEO of a bank or a purely industrial company. Of course, you can rely on the young people on your teams to be the ones challenging you and proposing new ideas,” Hieronimus said, “but if you’re disconnected from the world and from what people see, watch, read and listen to, when your teams are presenting something and you don’t understand what they’re talking about, it’s a problem.”

Being rooted in culture also gives Hieronimus an advantage as he grapples with larger sociocultural issues. Nina Jablonski, a professor emeritus at Penn State University, is a biological anthropologist who studies the evolution of human skin and skin color, and has worked with both L’Oréal’s Scientific Advisory Board and its Global Diversity and Inclusion Board, where she got to know the executive.

“Nicolas is someone who understands everything that is involved in meeting the challenge of diversity in a meaningful way and following through with implementation,” Jablonski said. “He’s really leaned into this, because he understands that when you have a corporation with 37 brands that serve the world and 21 research centers, you have to have diversity — not as a tagline or simply something that you can use as a sexy piece of marketing, but that you have to have meaningful implementation,” Jablonski continued. “It is part of the ethical framework of L’Oréal and part of the bottom line. For Nicolas, it is about serving your consumer base meaningfully.”

It’s a mission he takes personally, as well as professionally, said Lofti Ouanezar, the director of Emmaüs Solidarité, an organization that provides shelter and broad assistance to homeless people across France. Since 2021, L’Oréal has supported the development of five beauty spaces, with more expected to follow. “Nicolas is a man with a strong social conscience and a very humane personality,” said Ouanezar. “He loves people and was deeply touched by the story of a woman who used the beauty spaces, and how beauty and self-esteem can transform people’s lives. He’s sensitive to the work of the associates and believes that beauty can still change society and bring happiness.”

Ezgi Barcenas, chief corporate responsibility officer, joined L’Oréal in 2024 after a decade at Anheuser-Busch InBev, and said she’s discovered that that quality holds true across the board. “Creating the beauty that moves the world is the core purpose of our company,” she said, “but how Nicolas shows up to ask how we are really doing this is unusual.”

In April, Barcenas oversaw the launch of L’Oréal’s Sustainable Innovation Accelerator, with an endowment of 100 million euros over five years, to step up breakthrough technologies and drive the group’s sustainability strategy around four key areas: leading the climate transition, safeguarding nature, driving circularity and supporting communities. She’s been struck by Hieronimus’ willingness to look externally for solutions, as well as admit the work that needs to be done.

“Most often leaders tend to have experience or interest in one aspect of sustainability versus another, like social or environmental,” said Barcenas. “What’s unique about L’Oréal and Nicolas is the holistic, well-rounded approach to say, ‘How are we tackling climate change, but also finding solutions for water saving? What does the future of shampoo or face care look like in a water-stressed world?’ So really connecting the dots to multi-solve the environmental and financial challenges impacting the world and our communities.”

Answering such questions in real time is how Hieronimus, the sixth CEO in L’Oréal’s 116-year history, is making his mark. The company has always been adept at shape-shifting to meet the mores of the times, and Hieronimus, during his three-plus decades, has had a key role in the ongoing evolution of the business.

During the course of his career, he’s overseen the Consumer Products Division in the U.K., served as general manager of L’Oréal Mexico, oversaw the Professional Products Division and then the Luxury Division, before being named by Agon to the role of deputy CEO in charge of all divisions in 2017.

“This kind of career longevity is a competitive advantage,” said Agon. “Many people in other companies have thought that beauty is an easy business and that you could come from any other type of industry and have any type of marketing skill and you would perform well in beauty. That has proved to be wrong.

“The truth is that beauty is a very special type of business, it is an expert business, and it’s not by chance that L’Oréal outperforms the market and continues to gain market share year after year,” Agon continued. “The expertise comes with experience, and Nicolas’ experience is a major, major asset.”

Hieronimus is credited with transforming the Luxe division into the worldwide prestige beauty leader, taking it from a division with two key brands — Lancôme and Biotherm — into a fragrance powerhouse that today encompasses 27 brands and licenses, and spearheading the move to make the Active Cosmetics division into Dermatological Beauty.

As CEO, he’s realigned the company’s geographic division structure, decoupling North Asia and China from the rest of the region, and creating the SAPMENA-SSA region (South Asia-Pacific, Middle East, North Africa, sub-Saharan Africa) to better enable a focus on emerging markets. In 2024, the region generated almost 3.9 billion euros in sales, about 9 percent of total sales, and grew at a rate of 12.3 percent.

“Fifteen years ago, we were the number-one beauty company in the world, as we are today,” said Hieronimus, “but we were seen as a mass market beauty group with professional origins. Today, we are truly multifaceted — the leader in luxury and dermatology and still as strong in mass and professional, all while being very data- and tech-based.”

Going forward, the biggest game changer of all will be the implementation of artificial intelligence into all aspects of the business. If globalization was the mark made by former CEO Lindsay Owen-Jones in the ’80s and ’90s, and the digital and sustainability revolution the legacy of Agon, the impact of technology and transformation of L’Oréal into what Agon calls a “beauty tech” company will be the lasting impact of Hieronimus.

Hieronimus believes AI will supercharge L’Oréal’s ability to combine creativity, innovation and efficacy to drive scale, a force multiplier in helping achieve his goal of increasing the weight of new launches by 300 basis points. “AI is the big game changer,” he said. “Our capacity to create new molecules and formulas is augmented by AI, as is our capacity to create content for marketers, so we have stronger innovation power from our labs and at the same time give ourselves systematically the flexibility to add new initiatives.

“Because in the end, beauty is an offer market,” Hieronimus continued, “so you need to stimulate it. We are the leaders. It’s our role to stimulate that market. It’s about this permanent tension between the hard science and the reactive intuition.”

Reacting in real-time is often the province of agile indies rather than big organizations, but L’Oréal has kept pace, enabling it to outperform the competition. “I manage the company, and innovation in particular, in a double time frame,” said Hieronimus, meaning longer-term for breakthrough innovations like the ingredient Melasyl which eradicates age spots, and reactive short-term innovations that drive creativity and excitement.

“We have to be agile, to move fast, and when we’re challenged by indie brands, learn from what they do. That makes us stronger,” said Hieronimus. “Our digital savviness and capacity to adapt makes us very strong versus the other big players. We are more agile, we are more digital, therefore the spurs of the indies make the L’Oréal horse run faster.”

“We can repetitively come up with either very creative ideas or big innovations or both, and scale them globally and scale them fast,” said Hieronimus. “We have really cracked the code of how to transform inspiration into the beauty products that people want.”

Mix Master

Every year Nicolas Hieronimus curates a summer playlist for L’Oréal’s 94,000 employees. Here, his 2025 edition.

- “Petite Etoile” by Polo & Pan, Beth Ditto

- “Tell Me” by Camp Claude

- “Message Acide” by Lescop

- “Cry for Me” by The Weeknd

- “The Mirror” by Polo & Pan

- “RIP KP” by King Princess

- “I Let Myself Go Blind” by Kompromat

- “I Can’t Escape Myself” by The Dare

- “Run Free” by Soulwax

- “Dream Night” by Jamie xx

- “20 Anymore” by Swimming Paul

- “Quick Thrill” by Crystal Murray, Lava La Rue

- “Follow Me” by Hayden James

- “Hooked” by Franz Ferdinand

- “Hypra-Sensorial-Bellaire” by Yuksek, Bellaire, Partyfine, Voyou, Paul

- “NuevaYoL” by Bad Bunny

- “Banho de Mar – Blundetto Remix” by Joao Selva, Blundetto

- “End of Summer” by Tame Impala

- “Stay in Your Lane” by Degiheugi

- “The Contract” by Twenty One Pilots

- “Summer Is Almost Over” by Polo & Pan