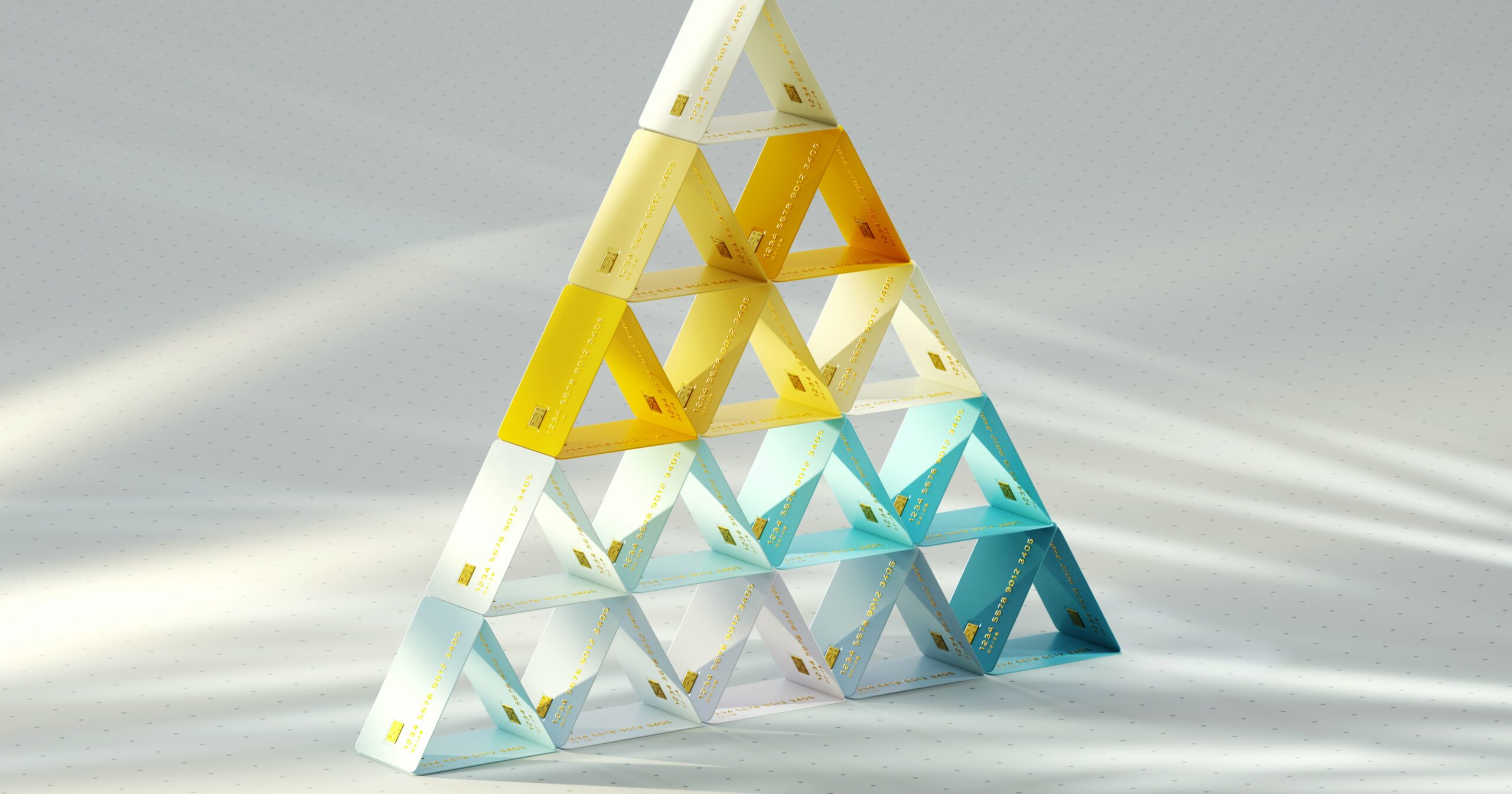

Making major financial purchases, like buying a house or a car, can typically only be done if your credit history is in good shape. Your credit history shapes your financial opportunities, and if it’s less than stellar, it can quickly feel more like a roadblock.

If your credit history isn’t ideal or you’re starting from scratch, the good news is that improvement is entirely possible. It may take time and consistent effort, but the benefits – from lower interest rates to increased financial freedom – are worth it. Improving your credit history isn’t just about numbers, either: it’s about cultivating responsible financial habits that pave the way for long-term stability and success.

To help you on your journey, PS tapped financial experts for their best tips on how to improve your credit history.

Experts Featured in This Article

Emily Irwin is a financial advice and planning executive, as well as the head of the Wells Fargo advice center.

Ebony Cochran, also known as The Debt Survivor, is the founder of Blackwood Credit Services, a credit counseling service.

Monique White is a financial educator and the head of community at Self Financial.

What Is Credit History?

Your credit history is a record showing how you’ve managed your debt – like credit cards or loans – over time. It details the accounts you’ve opened, how long they’ve been active, your payment history, and your total amount of debt owed. Lenders and financial institutions use your credit history to determine how reliable you are as a borrower. This information is detailed in a credit report, and you’re given an overall credit score.

How to Improve Credit History

Keep Track of Your Score

Tracking your credit score is the first step in learning how to improve your credit history. It reveals your financial strengths and areas for improvement, delivering a roadmap to better credit management.

“If you have significant credit card debt, then this should be your first priority,” Emily Irwin, head of the Wells Fargo advice center, tells PS. A credit-history check lets you know what kind of debt situation you’re in so you can better prepare yourself for payment plans to eliminate it.

Ebony Cochran, founder of Blackwood Credit Services, recommends “using a credit monitoring service for staying on top of your progress.” You can choose from free or paid services, but Cochran explains that either option provides “alerts on any changes in your report and highlights issues or improvements.”

Aside from tracking your score to know how to improve it, it’s also a good practice in case any errors appear. “Errors can damage your credit score,” explains Monique White, head of community at Self Financial. “It’s important to identify any inaccuracies, and file a dispute claim to get them fixed.”

Identify the Root Cause

If you have a poor credit history, one of the only ways you can improve it is by understanding the financial choices that have led you there. Cochran shared that some common causes to look for are “late payments, collections, or charge-offs.” In some cases, you may have options for rectifying some of these issues. She adds, “If late payments are impacting your score, reach out to creditors to request a courtesy removal or consider sending goodwill letters.”

Once you see what’s going on with your credit score and how it’s impacting your history, you know which choices you need to make in order to improve it. If you have an account in collections, prioritize paying off that debt. If late payments are an issue, make an effort to pay all your bills on time.

Stay Consistent With On-Time Payments

Making on-time payments is one of the factors that goes into your credit score, and it’s a key criterion creditors look for when assessing your reliability as a borrower. “Payment history accounts for 35 percent of your total credit score,” explains White, “which is why it is so important to pay your credit card bill on time.” Setting up automatic payments is an easy way to ensure bills get paid on time.

“The important thing to remember is consistency,” Irwin says. If you aren’t able to set up automatic payments, Irwin recommends, “set a monthly calendar event or alert on your phone a few days before your bill is due, or put a sticky note on your mirror as a visual prompt.”

Track Your Credit Utilization

Improving your credit history isn’t just about paying off your debts. One of the main purposes of a credit history is to show how you manage finances by utilizing credit. White says “credit utilization is the second-largest factor of your FICO score.” However, it’s a delicate balance, because “it’s important to not use too much of your available credit.”

As you’re monitoring your credit utilization, White recommends, “The rule of thumb for revolving credit is to not go above the 30 percent threshold. Using more than 30 percent of your available credit can affect your credit utilization, which could ultimately decrease your score.” To paint the picture of what that looks like, White explains, “If your credit limit is $1,000, you should not be putting more than $300 on your credit card.”

It may seem counterintuitive, but Cochran warns that “insufficient credit activity can hold you back.” To demonstrate a strong credit and payment history and build your credit score, she recommends “establishing 3-5 open credit accounts with responsible usage.”

Set Up a Budget

Whether you’re paying off debt or working on improving your credit utilization, you need to set up a budget to help you better manage your finances. A primary reason many people find themselves with poor credit history is financial instability. Cochran explains that “implementing a monthly budget and tracking spending can help get you back on track.”

If you’re new to budgeting, White recommends following “a structure like the 50/30/20 method, where 50 percent goes to your needs, 30 percent goes to your wants and non-essentials, and the remaining 20 percent can focus on savings.” If you’re focused on paying off debt, your ratios might look a little different. “Reassess your budget to prioritize your credit card payments, even for the short term,” she says. “It’s important to reallocate certain funds toward your credit card payments until you pay them off.”

Cultivating responsible credit usage, paying off debt, and keeping track of your finances and credit score are all key to improving your credit history. It’s important to remember that this process is not a one-off solution. Instead, this work will help you establish better financial habits to make decisions that consistently maintain a solid credit history.

Kate Fann is an established writer with 10 years of freelance writing experience. She focuses on creating engaging content for lifestyle brands, covering home, technology, and entertainment.