PARIS — L’Oréal has taken a minority stake in Swiss longevity biotech company Timeline.

Terms of the deal, which was made through the beauty giant’s strategic venture capital fund Business Opportunities for L’Oréal Development, were not disclosed.

Timeline was founded in 2007 by Chris Rinsch and Patrick Aebischer as a spinoff of the Swiss Federal Institute of Technology. It develops solutions for longevity in the food, business and health categories.

Rinsch serves as Timeline president, and Aebischer is its chairman.

Related Articles

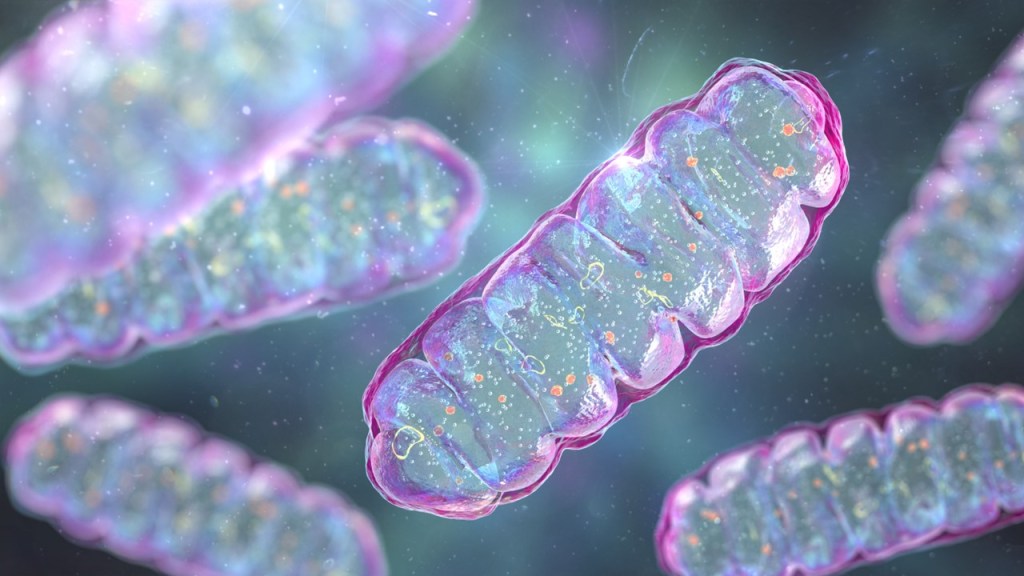

“Timeline has developed a proprietary molecule, Mitopure, that recycles and rejuvenates aging mitochondria, the powerhouses of cells,” L’Oréal said in a statement Tuesday. “This breakthrough technology is backed by more than a decade of research by distinguished scientists, multiple gold standard clinical studies and an unparalleled intellectual property portfolio. The investment will enable Timeline to further develop its unique technology and expand operations, while enabling future collaboration with L’Oréal.”

The beauty industry’s lexicon — and focus — keep expanding. Health, then well-being, were buzzwords in the recent past. Now, with the convergence of those two and scientific advances, longevity is becoming a key talking point and market shapeshifter.

“Longevity is about living healthier for longer, and L’Oréal has been working for more than a decade to understand and anticipate what this could mean for beauty,” said Barbara Lavernos, deputy chief executive officer and in charge of research, innovation and technology at L’Oréal. “Longevity adds a new dimension to beauty, focused on predicting, correcting and even reversing the aging of our skin, scalp and hair. Our investment in Timeline is exciting for its potential to transpose key hallmarks of longevity onto skin health and beauty.”

“This strategic collaboration reflects the breakthrough multidimensional approach that we’ve always believed is necessary to make meaningful advancements for longevity and health span,” Aebischer said.

BOLD has been ramping up its acquisition pace. On Jan. 9 it revealed it had acquired environmental water-tech start-up Gjosa. Investments for the venture capital fund last year included in Shinehigh Innovation and in Genomatica Inc., an initiative centered on developing, producing and commercializing biotechnology-based alternatives to key beauty product ingredients.