Today’s consumers have become so demanding, premium and luxury retailers must surprise and “delight them more than anyone else.”

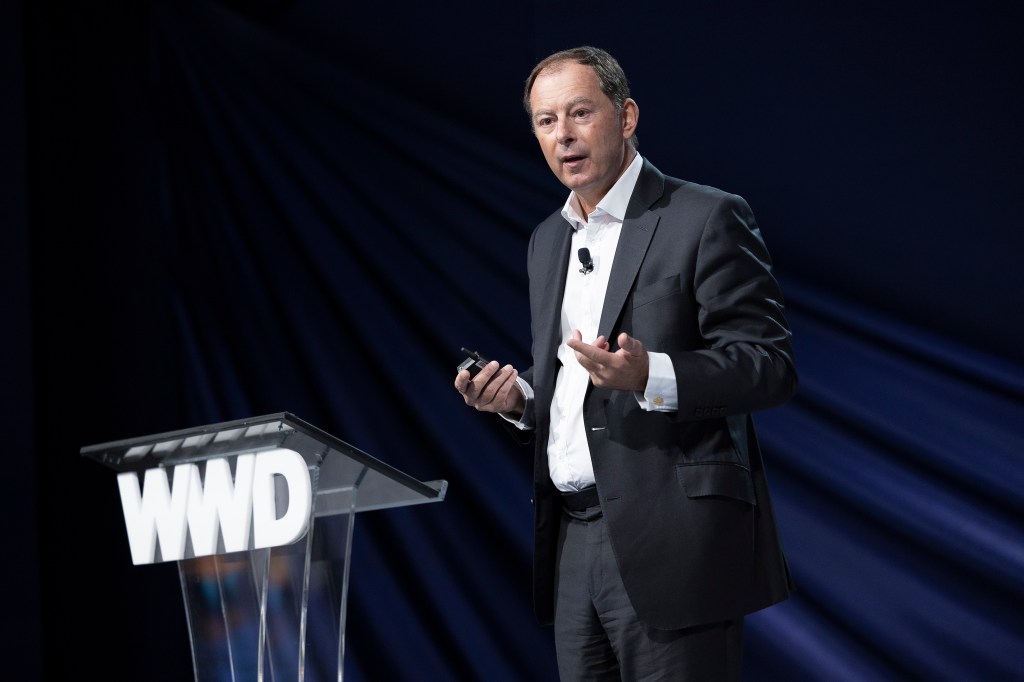

So says Chris de Lapuente, chairman and chief executive officer of the selective retailing division of LVMH Moët Hennessy Louis Vuitton, which clocked gains of 26 percent last year and in the most recent quarter.

Generating around 15 billion euros in revenues annually, it’s the second-largest division at the French luxury group after fashion and leather goods, comprising Sephora, which has grown fivefold over the last dozen years; travel retail specialist DFS; cruise-ship retailer Starboard; website 24S; grocery retailer La Grande Épicerie de Paris, and department stores Samaritaine Paris and Le Bon Marché.

“We are expecting a fourth quarter of double-digit growth as well,” de Lapuente predicted.

But all retailers have to work harder than ever to keep consumers coming back.

“You come to the store not just to buy your product, but you come to experience, you come to discover things that you might have not expected, the elements of surprise, the wow, the stories, the relationship,” he told the WWD Apparel & Retail CEO Summit in New York City on Oct. 24. “We believe the role of stores is changing. Boring retail may be dead, but exciting retail is alive and kicking.

“Stores are going to have to work harder and harder to excite the customers and make the effort to delight them,” he said.

De Lapuente made a compelling case for “retail entertainment,” roaming the stage and flashing slides showing how Le Bon Marché in Paris is sparking curiosity with storewide displays, like a recent invasion of strange pink figures by iconoclastic French artist Philippe Katerine.

The Left Bank department store is now in the habit of clearing away the beauty stands in its vast nave to make way for immersive evening theater performances, for which customers pay 75 euros. The executive noted that 17,000 people attended a dramatic interpretation of Émile Zola’s “Au Bonheur des Dames” earlier this year, and a fall spectacle, “Cirque le Roux,” has already sold more than 10,000 tickets in less than two months.

“This delights our customers and they feel they’re living a special experience,” he said.

Likewise, some 4,200 beauty enthusiasts recently paid between $120 and $370 to attend a New York engagement for Sephoria, the beauty festival hosted by Sephora that debuted in Los Angeles in 2018. De Lapuente noted some 90,000 people joined the Manhattan event via the internet, suggesting customers appreciate such “insider” opportunities.

“The dream and ambition would be to do this in most of the major cities,” he said of the fairs, which have also been staged in Paris and Shanghai recently. “It will be the place where you go to discover what is hot, exciting and trendy in the world of prestige beauty.”

De Lapuente also touted the art of curation and the need to take brand partnerships to the highest levels. Of about 2,200 brands carried at Le Bon Marché, roughly one-third are exclusive, including fashion line Sézane and jewelry-maker Maria Tash.

Dior’s takeover of Harrods in London last holiday, with a gingerbread-palooza encompassing the entire store, was “truly remarkable,” exemplifying “fantastic storytelling,” he argued.

Meanwhile, aboard cruise ships destined for Alaska, Starboard teams created a bespoke store of exclusive, unique products that travelers could purchase as authentic souvenirs.

The executive also trumpeted the need for retailers to build communities, noting that Sephora boasts 60 million regular customers, and that Le Bon Marché employs a dozen personal shoppers. “I would like to have 100,” he said. “This has to be a major area of focus.”

In a similar vein, he noted the department store boasts 50 stations where various products can be personalized — a number he would like to double.

Finally, he stressed the need to put “people and culture” at the heart of the business.

Echoing other speakers at the WWD event, de Lapuente cited the growing challenge of staff retention in retail, especially after the pandemic, which prompted widespread questioning about the “work-life balance” and popularized remote working on — simply not possible in retail, when evenings and weekend shifts are the norm.

“We need to focus on better retention, better career development,” he said. “Post-COVID-19, the challenges are even greater than before.…We are gradually introducing more flexible work arrangements.”

On the diversity front, de Lapuente said his division has made major strides. When he arrived, about 70 percent of the top 100 executives at Sephora were men. “Ten years later, we flipped it,” he said, flashing a slide of Artemis Patrick, the first female leader of Sephora North America in 25 years.

He noted Patrick is on track to be the first female CEO of the prestige beauty retailer’s North American arm when current president and CEO Jean-André Rougeot retires next year.

“Across the whole of selective retailing, about 65 percent of our top leaders are female,” he said, noting “it’s not something that’s happened in five minutes: It’s taken us 10 years to get there.”

“We need to be braver, and more courageous managing the careers of young people,” he added.

Sephora is also seeking more diverse suppliers, identifying promising beauty entrepreneurs of color under its Accelerate program.

“You can keep on waiting and waiting for another Rihanna to come along. Alternatively, you can go out and look for young, promising founders, and you work with them in the kitchen coaching, helping them develop,” he said.

During a question-and-answer session, de Lapuente trumpeted the Sephora at Kohl’s initiative, initiated in 2021 with the opening of 200 shops-in-shop and expanded since. He cited “zero cannibalization” and “all incremental” business.

“There are others who have tried to follow our example, and it often doesn’t feel like prestige,” he opined. “We do $1 billion at Kohl’s and we think we can double it.”