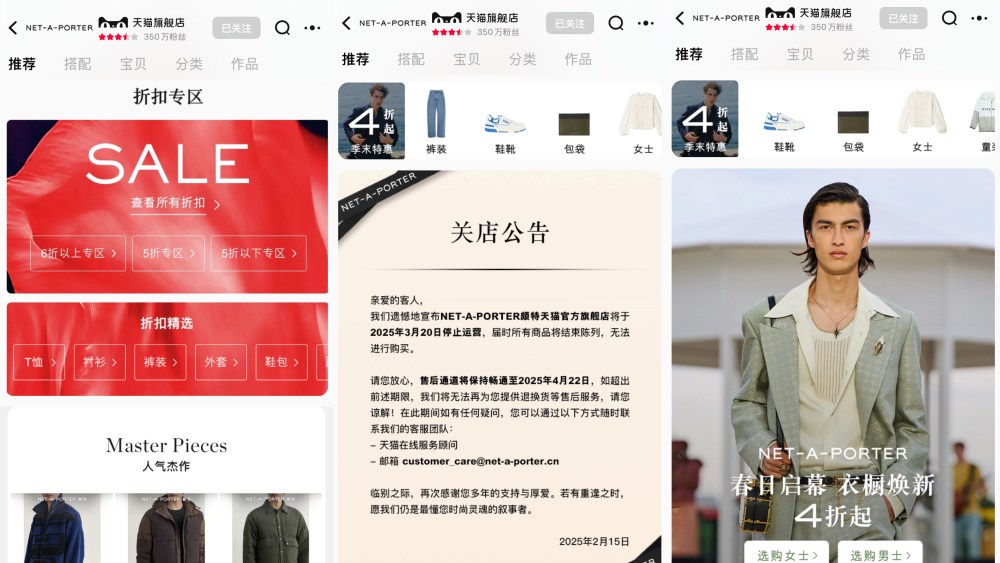

Net-a-porter’s China operation Fengmao, a joint venture between Alibaba and Yoox Net-a-porter, will be terminated on March 20, the e-tailer confirmed over the weekend.

Customers will no longer be able to place orders from that day across all of Net-a-porter’s online channels in the Chinese market, including the Tmall flagship, WeChat Mini-program, Xiaohongshu, and Douyin Store.

After-sales services will be provided until April 22, Net-a-porter said in an announcement published on its Tmall flagship.

Net-a-porter’s China exit has been in the planning since last summer, when Yating Wu, former chief executive officer of Fengmao, who now serves as CEO of Compagnie Financière Richemont Southeast Asia and Oceania, broke the news during a meeting with employees. Net-a-porter China has since been offering hefty discounts to liquidate remaining stock.

You May Also Like

It is understood the dissolution of the China joint venture is part of a wider plan by YNAP to exit China in order to focus investments and resources on core and more profitable geographies.

Another reason behind the dissolution of the partnership could be that Richemont needs to tidy up the business and wind down any long-standing partnerships before completing the sale of Yoox Net-a-porter group to Mytheresa, which is expected to occur in the first half of calendar year 2025.

Richemont is selling YNAP to Mytheresa with a cash position of 555 million euros and no financial debt, in exchange for shares. Richemont will also make available a six-year revolving credit facility of 100 million euros to finance YNAP’s general corporate needs, including working capital.

In exchange, Mytheresa will hand Richemont a stake representing 33 percent of its fully diluted share capital. Richemont also has the right to nominate a member and an observer to the Mytheresa board.

Last month, Mytheresa said after the acquisition, its holding company will be called LuxExperience, and its ticker on the New York Stock Exchange will be changed to “LUXE.” Mytheresa will still exist as a retail brand within the group.

Mytheresa said the new name reflects the company’s ambition to build “a leading, global, multibrand digital luxury group that creates communities for true luxury enthusiasts and desirability through unique digital and physical experiences.”

Net-a-porter entered the Chinese market in 2013 and launched a mainland China operation with industry veteran Claire Chung appointed as general manager in 2015. The same year, Net-a-porter’s off-season sister operation, The Outnet, exited the Chinese market due to stiff competition.

In 2018, in a bid to take up a bigger slice of the Chinese luxury e-commerce market, Richemont signed a strategic partnership with Alibaba Group to bring the retail offerings of YNAP to Chinese consumers via Fengmao.

A year later, Net-a-porter opened its flagship on Tmall’s Luxury Pavilion offering a wide selection of more than 130 luxury and designer brands such as Brunello Cucinelli, The Row, Balmain, Isabel Marant, Jimmy Choo and Tom Ford. The same year, Yoox closed its China website.

The joint venture happened at a time when Alibaba was looking to gain fashion credibility and court major luxury players such as LVMH Moët Hennessy Louis Vuitton and Kering. It also wanted to knock out arch rival JD.com, which was backing Farfetch at the time in a bid to dominate the luxury space.

The partnership with YNAP helped Alibaba to populate its search results with legitimate luxury products and urge brands to sign direct deals with the platform.

Richemont and Alibaba took their relationship to the next level in 2020, partnering with Farfetch on a landmark deal that aimed to give Farfetch “enhanced access to the China market” and accelerate the digitization of the global luxury industry.

But China’s digital shopping boom came to an end in 2021 when the local authorities began to crack down on the tech sector. Two years later, Farfetch collapsed into administration, and was later sold to South Korea’s Coupang at a knockdown price of $500 million.

At the same time, Alibaba has been struggling to maintain a high level of growth post-pandemic. It is now facing stiff competition from physical luxury stores in China, which have gotten a major upgrade over the past five years.

Today, there are many ways for Chinese fashion consumers to shop for luxury. They no longer have to rely on Tmall. The popular social commerce platform Xiaohongshu, for example, has become the preferred partner for Louis Vuitton in China.

At the same time, JD.com began to offer omnichannel solutions to luxury brand partners in 2020 and has attracted a slew of high-profile names, including Mytheresa, to sell on the platform, bringing Alibaba’s dominance in the realm of luxury e-commerce in China to an end.

To reinforce its presence in the Chinese market, Mytheresa last September revealed a new Chinese name and launched on WeChat’s Mini Program.

Its Chinese name Mei Lin Shi, which translates as “beauty,” “selection” and “world,” respectively, is meant to capture Mytheresa’s proposition of offering a curated “assortment of the most coveted luxury brands as well as exclusive collections for a community of true luxury enthusiasts and their lifestyle,” said the company in a statement.

Mytheresa’s Mini Program will include a selection of more than 180 luxury brands across womenswear, menswear, and kidswear. Users will be able to benefit from personalized recommendations, live chat support, and secure checkout via WeChat Pay. Orders will be fulfilled by Mytheresa’s European warehouse.

Dede Chan Brignoli, Mytheresa’s newly appointed president for Greater China, formerly the head of e-commerce for LVMH in the Greater China region, told WWD earlier that the launch of the WeChat Mini Program will “continue to boost our reach to Chinese consumers in innovative ways as we strive to cater to their ever-evolving needs. This marks a new and exciting Chinese chapter for Mytheresa and it is just the beginning.”