With the East and Gulf Coasts port strike continuing, U.S. retailers are getting increasingly anxious about their holiday season.

They already had low expectations for sales gains in the 2 to 3 percent range, but now with container ports shut down from Maine to Texas, there’s a growing undercurrent of concern, in particular about the back end of the season, when they could experience a dearth of replenishment and early spring goods. Those orders typically arrive in stores around December and will be floating on water rather than sitting on shelves and in warehouses, if the strike persists.

“Right now, my clients don’t seem to be bothered by the strike,” said Balika Sonthalia, senior partner and head of Kearney’s strategic operations practice for the Americas. “But as we get further into December, there could be an imbalance in supply and demand.”

You May Also Like

NRF Fears Strike’s Impact on Holiday Sales

On Wednesday, the National Retail Federation sent a letter to President Biden, signed by 272 trade associations representing American manufacturers, farmers and agribusinesses, wholesalers, retailers, restaurants, importers, exporters, distributors, transportation and logistics providers, and other supply chain stakeholders, pleading for him to end the strike.

“Our farmers are not able to sell their crops to overseas markets, manufacturers are not able to receive critical components for manufacturing facilities, retailers won’t be able to get their holiday merchandise in time and many other industries will be negatively impacted. The longer a strike occurs, the more severe the economic impact and the longer it will take to recover,” the letter read. “The strike will cost the economy billions of dollars a day,” the letter indicated. As of Wednesday afternoon, the NRF did not receive a response.

“Many of our members planned appropriately and took mitigation steps, bringing goods in during the peak shipping season. Others diverted goods to West Coast ports,” said Jon Gold, vice president of supply chain and customs policy at the NRF. “Unfortunately, retailers are not able to bring in everything in advance. That could have an impact on holiday, depending on how long the strike occurs.”

Gold said that if the port shutdown lasts for seven days, it will be four to six weeks before everything gets cleared and operations return to normal. If the strike lasts for two weeks, the industry is looking at three months plus for a recovery.

Typically, the peak shipping season for holiday goods runs from late June through early November. “This year, the front-loading began as early as May,” due to the strike and retailers planning for earlier holiday shopping.

“Just shy of 50 percent of all imports to the U.S. come through East Coast and Gulf Coast ports,” said Gold. Categories coming through the East and Gulf Coast ports in a big way are apparel, footwear, consumer electronics, home goods, perishables, frozen food, toys, construction vehicles home building and repair equipment and materials, according to Gold. Others added generators, wines and liquors to the list.

Retail Contingency Plans

“Bigger companies like Kroger and Costco with large warehouses storing merchandise can handle supply chain disruptions better than smaller retailers operating with just-in-time inventory which are going to be harder-pressed,” said Darpan Seth, chief executive officer of Nextuple, a software and advisory firm for inventory and order management.

“Distribution centers and stores for the most part ordered months in advance with long lead times and have enough inventory at this point, but I do see delays happening with spring merchandise, anything that’s out on the ocean, and the same holds true for replenishments,” said Seth. “Demand signals are always there. Replenishment orders are going out all the time. It’s a constant process, unless the product is seasonal.”

“Savvy retailers planned ahead anticipating a port strike by timing receipts earlier, for midsummer versus typically around Labor Day, and they began redirecting more of their shipments to West Coast ports,” said Craig Johnson, president of Customer Growth Partners. “August imports into the Port of Los Angeles were up 18 percent; East Coast ports were minus 5 percent in August,” Johnson said. “Certainly additive was the fact that retailers are starting holiday selling earlier.”

Shipping and Wall Street analysts believe the strike has a $4 billion to $5 billion impact on the gross domestic product each day. “That may be a little bit overstated,” Johnson suggested. “But if the strike goes all the way to Black Friday, the economic impact will reach those estimated levels.”

Normally, Johnson said, fourth-quarter replenishment merchandise arrives in December, and spring orders arrive in mid-to-late December.

While Kearney’s Sonthalia speculated that the strike would end sometime in October, Johnson said, “Nobody really knows how long the strike can last.”

In the near-term, retailers such as Lowe’s, Home Depot, Tractor Supply, Target and Walmart will see a one-time spike in the Southeast in categories around construction, home repair and essentials. Also, Ingles, a regional grocer based in Greensboro, Ga., should see a spike in business.

Packaways Give Offpricers an Edge

Offpricers are positioned well despite the strike because of a purposeful practice they employ called “packaway” involving storing seasonal goods in warehouses for months to sell in future seasons. Johnson singled out Ross Stores, noting that the off-pricer is based in Dublin, Calif. “Ross is particularly advantaged, most of their merchandise is from China and elsewhere in Asia, and comes into California ports.”

Regarding the strike’s impact on hurricane recovery efforts, Johnson said there could be some delays on construction equipment and vehicles that typically come through East Coast ports. But he also said grocery and convenience stores should be up and running relatively soon. “The number-one thing you need is clean water. All the major retailers will be doing whatever they can to support relief efforts but the roads and electricity have to be restored,” said Johnson.

Sonthalia noted that major retailers have backup operations in areas outside the path of the hurricane that will replenish their stores for much-needed essentials and home repair products in areas impacted by the event.

However, in some cases, holiday shipments of fashion and gifts could be delayed further by retailers prioritizing receipts of hurricane recovery merchandise, such as lumber, dry wall, insulation, screws and nails, blankets, and plastic water bottles.

Perishables, including bananas, coffee and cocoa to a large extent come from South America and the Caribbean via Georgia, but some of that can also be sourced from California.

“There are also perishables from a fashion standpoint,” Johnson said. If outerwear doesn’t reach the store shelves by December, they will languish on the shelves and get liquidated. Redirecting imports to ports that are operating means another 15 to 20 days before arriving to retailers — and extra freight costs Johnson said.

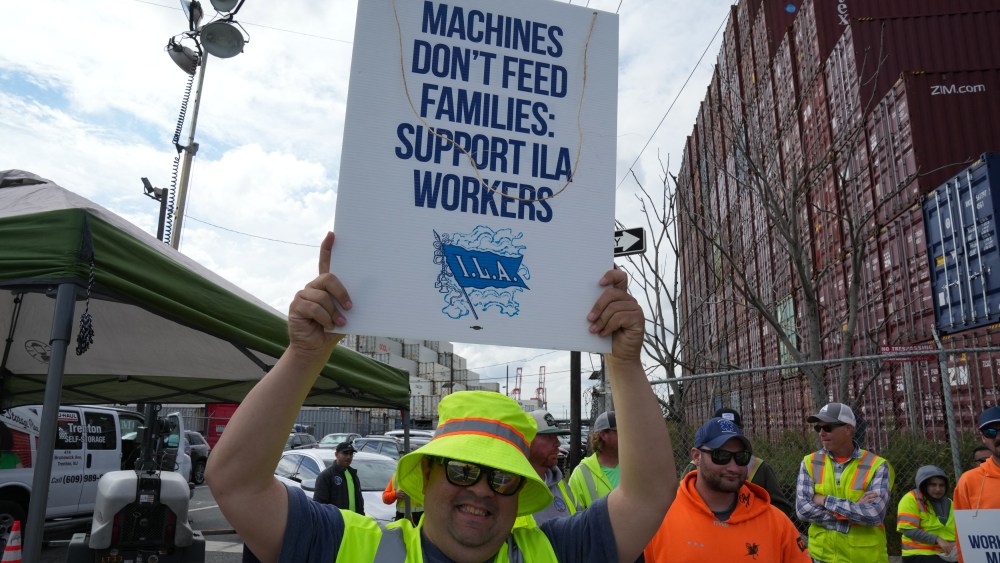

Roughly 45,000 dock workers are on strike at 36 ports through the South and along the Gulf Coasts, from Maine to Texas. The strike began Tuesday.

“In retailing, every day the ports are closed creates about a week delay on inventory arriving to stores. A five-day strike means a five-week delay. That is a model a lot of container companies use to communicate to customers,” said Sam Vise, chief executive officer and cofounder of Optimum Retailing, a 15-year-old software platform focused on inventory management and helping retailers move goods to their stores where there’s the demand for goods, and manage through supply disruptions.

Some industry experts believe many retailers are already sufficiently stocked with holiday merchandise in their warehouses. But Vise said even those that have been receiving goods early in anticipation of the ports strike could find themselves with shortages at the beginning of the season and with merchandise gluts around late November and into December, leading to intensified discounting. “The strike coupled with the hurricane will be disastrous getting things back online,” Vise said. “My sense is that we will be seeing companies launching holiday earlier, but I don’t think it was in anticipation of the strike.”

“My hope is that the strike doesn’t last more than five days but anything longer will have a lengthy impact on holiday. The whole supply chain (could be) thrown off,” said Wise, who noted that Sephora and Verizon are among the clients at Optimum Retailing, which is based in Toronto and Burbank, Calif.

DHL Global Forwarding said it has comprehensive contingency plans to mitigate the impact on customers and the flow of goods. Those safeguards include leveraging alternative port options, transferring goods from one mode of transportation to another, and air freight alternatives.

In a statement, DHL Global Forwarding said, “We anticipate minimizing delays and meeting the needs of our customers. However, it is too early to assess the full impact of the strike actions, but there could be ripple effects across various sectors, including retail and manufacturing, especially as we approach the holiday season. Delays will depend on the duration of the strike and the volume of affected cargo.”

Hurricane Losses

As of Tuesday, the estimated total insured losses from Hurricane Helene were expected to be up to $34 billion, according to Moodys Analytics. And the estimated immediate retail sales impacts were a $603 million gain for DIY/home center sales and a $652 million decline for apparel retail sales, according to Planalytics. AccuWeather has increased its estimate of the total damage and economic loss from Hurricane Helene to $145 billion to $160 billion.

The most catastrophic flooding occurred in the southern Appalachians including Asheville, N.C., and surrounding areas, and west coast sections of Florida, such as Tampa Bay, hit by huge water surges. Hundreds of individuals as of Wednesday were still unaccounted for and the death toll was approaching 200.

“The hope is that the strike doesn’t last more than five days but anything longer will have a long impact on holiday,” said Wise. Also, he expects a glut of goods arriving late to retailers, leading to extreme discounting to move the merchandise quickly to make room for more seasonal goods.

At Macy’s, all of the company’s colleagues were accounted for in the region, a spokesperson said. “Our stores from the Gulf Coast of Florida through Georgia and into the Carolinas experienced minor impact from localized power outages or minor leaks/flooding that were quickly remedied. A total of 46 stores in the region were closed during the storm’s duration and only one store in Augusta, Ga., sustained significant impact,” she said.

Retailers’ Relief Efforts

Macy’s has donated $25,000 in response to the American Red Cross for the hurricane relief efforts. Through Oct. 15, select Macy’s stores in central Florida, North Carolina and South Carolina will offer customers the opportunity to round up their in-store purchases to the nearest dollar (up to 99 cents) to benefit Hurricane Helene relief efforts through the Hispanic Federation. All of the funds raised will benefit Hispanic Federation’s disaster relief fund. Employees can apply for emergency relief grants through The North Star Relief Fund, a designated 501(c)(3) charity that is funded primarily by Macy’s and its employees.

Macy’s said the port strike has had no impact on our disaster response efforts.

Walmart declined to discuss how the port strike was impacting its business, but did comment on supporting hurricane relief efforts, stating on its website, “Walmart, Sam’s Club and the Walmart Foundation are committing an initial $6 million in support of hurricane relief efforts, including donations of food, water, essential supplies and grants to organizations providing relief. Many associates, customers and members in the communities we serve are experiencing the devastating impacts of Hurricane Helene. Our thoughts are with those affected, and we are acting quickly to help…” As part of this commitment, Walmart also matched donations to the American Red Cross 1:1, up to $2.5 million. Walmart is also providing showers, laundry stations and mobile charging stations to areas hit by the hurricane.

In response to Hurricane Helene, federal and state regulatory agencies have taken such measures as waiving ATM fees and overdraft fees, eased credit terms for new loans, waived late fees for credit card and other loan balances. As a sign of the extensive damage, the Federal Reserve is also offering guidance to banks to handle contaminated cash.

Target pitched in with relief and recovery efforts by donating $3 million that will be distributed to local and national disaster relief organizations, including Convoy of Hope, the social impact organization SBP and local food banks among other agencies.

In addition, earlier this year Target had proactively donated $1.5 million to domestic relief partners such as the American Red Cross, Team Rubicon and Feeding America, to help them respond quickly with food, financial aid, medicine and essential supplies to communities in crisis. Target has also provided essential resources to team members in heavily impacted areas.

Starting last Thursday, JCPenney associates in areas FEMA declared as federal disasters including Florida, North Carolina, South Carolina and Georgia could request emergency grants from their employee assistance fund, the Golden Rule Relief Fund. As of Wednesday, all JCPenney locations, with the exception of its Asheville, N.C. location, have reopened.

Without specifying which locations in its national chain are temporarily closed, Dollar General said Tuesday that it was evaluating select store locations and will reopen in communities, “when it is safe for employees and customers,” according to a company spokesperson.

Meanwhile, Dollar General’s partnerships with several relief organizations are helping impacted communities recover from Hurricane Helene, a company spokesperson said. “Our work with and financial support of the American Red Cross and World Central Kitchen, the Dollar General Employee Assistance Foundation and the Dollar General Literacy Foundation’s ‘Beyond Words’ grant program are fulfilling our mission of ‘Serving Others,’ while providing hope, help and needed support,” the spokesperson said.

– With contributions from Rosemary Feitelberg