For 125 years, Nordstrom has been defined by its namesake family. Now the retailer’s fourth-generation leaders are kicking off a new chapter with the same tried-and-true mission.

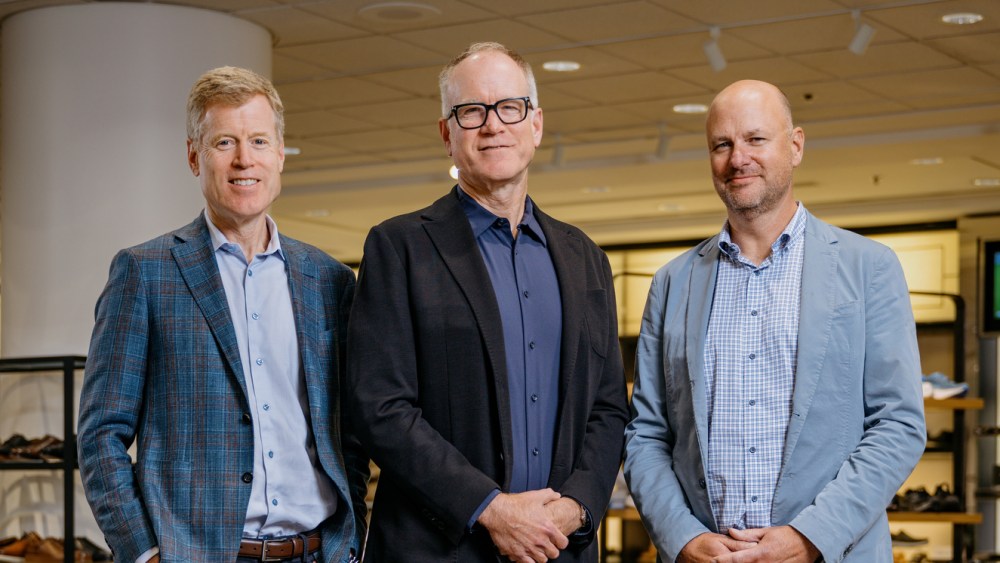

Brothers Erik and Pete Nordstrom, who serve as co-chief executive officers, and their cousin Jamie, the chief merchandising officer, along with El Puerto de Liverpool, finalized their $6.25 billion, all-cash acquisition of the department store chain in May 2025. The Nordstroms now have a 50.1 percent controlling stake in the company, and Liverpool, Mexico’s leading middle-market department store chain, holds a 49.9 percent stake.

In a wide-ranging conversation, the Nordstrom brothers gave their perspective on what privatization means to the business, how the company can be managed differently — and cleared up some misconceptions on the transaction. They also discussed their growth strategy, company performance and the plans to mark the 125-year milestone.

You May Also Like

“We’re playing from a position of strength,” Erik said. “We think we have the best mouse trap. We’ve got capabilities in stores, online, off-price and how it all works together. We feel really good about where we are and our ability to stay focused and execute well, particularly in this market where there’s some opportunity.”

Time Better Spent

“In a lot of ways, it’s business as usual,” said Pete, when asked about changes since taking the company private. “As far as customers are concerned, it doesn’t change it at all. Strategically, operationally, all the things we do, there’s nothing that’s really changed.”

Still, the way the Nordstroms operate has evolved now that the family is out of Wall Street’s glare. “A lot of that has to do with the time we spent on specific, public-related things that we don’t spend time on anymore. We have more time to do the stuff that creates more value for the business, and it speeds up decision-making,” Pete said.

“We are able to obtain clarity faster. Decisions happen faster. It also contributes to the enjoyment of the job,” he added. “It feels like the cause and effect of what we can do is more connected, which is great. Literally, it’s Erik and I sitting in a room. Our offices are right next to each other.”

“We use the word ‘focus’ a lot,” said Erik. Privatizing the company “helps us focus” — on the business, its legendary service, and what must be done to remain competitive. “Ultimately, it should play through the company that we’re focusing on the things that make a difference to customers and our folks. But it’s not a bold change.”

For most Americans, Liverpool, the department store chain based in the Santa Fe section of Mexico City, is an unknown, but the alignment between the two companies was a crucial part of the deal. “They’re really good retailers. They’re very long-term focused,” Erik said. “They want to put money into the business. They want everybody to succeed long-term and are very supportive of us doing that.”

Upon taking the company private, a new board with seven members was created, including Erik, Pete and Jamie Nordstrom, three Liverpool leaders and one independent director. It’s a streamlined structure, down from 12 members, with a diversity of career experiences. “Everyone sitting around the table now is a retailer, so we get into subjects much faster,” Erik said. “They understand the context. There’s a lot of common ground of what they’re working on and what we’re working on.”

Still, according to the brothers, the general public has misconceptions about the new partnership. “It’s not about financial engineering, private equity, or investors looking to take money out of the business,” Erik said.

“People don’t fully understand that it’s not a merger,” Pete added. “There’s nothing about our relationship with Liverpool that requires synergies and things to happen in a collaborative way across the businesses. They’re investors in our business. To the extent there are things we could leverage off each other, we’ll do it. And there’s some low-hanging fruit. But for the most part, it’s really them trying to understand exactly what we’re doing and how they can be supportive of it. They’re not trying to come in and dictate something. There’s no agenda other than us just being the best Nordstrom we can be.”

Importantly, the Nordstroms said the transaction hasn’t saddled the company with debt, unlike a number of other high-profile deals. (Saks Global went bankrupt last month partly due to its debt load, though negative sales trends over the last several seasons were also a factor.)

“We have less debt now than we did a year ago,” Erik said. “We didn’t take on much debt for the transaction, and with what we did, we’ve been able to pay it off already, just from the cash of the business.”

Nordstrom Inc.’s sales in 2024 reached $14.56 billion, up from $14.22 billion the year before. Net earnings more than doubled to $294 million from $134 million in the year before. Since becoming private, the company no longer reports its financial results.

Meeting of the Minds

The Nordstrom and Liverpool teams have been coming together on the digital side and in other key areas. “We can really be transparent with them and they can be transparent with us,” Erik said. “So we’ve had a number of our teams starting to spend time with some of their teams and sharing ideas and trying to learn from each other.”

Members of the Nordstrom team have been visiting Liverpool on its home turf. “There have been different exchanges that have happened organically. It can be logistics people or tech people [discussing] tactical areas, so we can know more about best practices,” said Pete. “It isn’t literally the retail business. It’s about the ancillary parts being more efficient.”

Aside from both being successful retailers, the companies are more different than alike. Nordstrom is primarily focused on designer and premium apparel, shoes, beauty and accessories. Liverpool, by contrast, is a traditional department store and the fifth-largest retailer in Mexico with about 300 stores under the Liverpool and Suburbia nameplates. The retailer has a mass approach, selling many categories, from fashion and furniture to cell phones, motorcycles and refrigerators.

In the Mexican market, “Liverpool has a really high share,” said Erik. “Their profit margins are really high. It’s just a well-run business. I admire their curiosity and willingness to get into different businesses. They’re not afraid to go into low-margin businesses if it helps retain customers and drives some dollars, versus worrying about profit margins. They’ll try things and if something doesn’t work, they’re pretty quick to move on.”

There have have been no indications that Liverpool bought into Nordstrom as a prelude to eventually expanding its own business into the U.S., or to one day possibly acquiring a majority stake in Nordstrom.

While the two retailers have different offerings, there are some commonalities. “If there are things they aspire to do and want to do, and we already do it, it’s a benefit to them,” Pete said.

Curating ‘Big Time’

One of the priorities over the past year has been to refine Nordstrom’s in-store mix. “Perhaps more than anything else, we got focused on our assortments,” Erik said. “Online, it’s about having a ton of selection and assortment. You can’t do that in a store because you’re constrained by your physical space. That’s where it’s really much more about curation.”

Of course, the strategy continues to evolve “because brands come and go and customer preferences come and go,” Erik said. “But our ability to edit and focus on that has paid off big time and has allowed us to put a more relevant selection in each store, and in better quantities. The best stuff is the best stuff everywhere in the country, so we don’t have to be super surgical.”

Buyers are making “tough choices” in the editing process, Erik acknowledged. But the upside is, “We’ve been able to have more of the things customers want. That sounds obvious, but it does take a level of discipline to do that.”

Overall, the goal has been to attract a higher percentage of younger customers. (The average age right now is “fortysomething.”)

“We love our legacy customers, but we’ve got to bring new people in,” Pete said, adding that the buyers must look beyond what’s been selling historically. “There’s a lot of opportunity for us to have that balance of discovery and the stuff people expect we would have, and [to] find ways to get new, young customers in the door to keep the store relevant and modern.”

Being innovative, contemporary and youthful in the offering is key. “We’ve grown the designer and luxury part of our business quite a bit over the years, and by virtue of that alone, because that merchandise is more expensive, it tends to have an older customer,” Erik said. “So it’s important that we balance that out.”

Last year, Nordstrom strengthened its Young Adult assortment with the addition of Princess Polly, Petal and Pup, Florence by Mills and others.

Elsewhere in the mix, strategic investments, including a partnership with Muse — the anchor of Nordstrom’s new fine jewelry hall in the Manhattan flagship — have also been a priority.

Looking ahead, Nordstrom plans to add a number of brands to the women’s mix in 2026, including Hill House Home, NikeSkims, Nobody’s Child and Sndys, among others.

Rolling Out Rack

At Rack, Nordstrom’s growing off-price brand, the average age is a little younger, Erik noted.

“Rack stores are our biggest point of customer acquisition,” he said. “A good chunk of new Rack customers end up migrating to Nordstrom in the first three, four years of being with us. That ecosystem, that flywheel, is working for us, and as we open more Rack stores, it [increases] customer acquisition and brings in younger customers.”

Erik noted that the company is several years into accelerating that division. Twenty-two Rack units were opened last year, bringing the count to 298. “We are challenging ourselves to get to 50 stores a year [being opened]. We see those opportunities out there,” he said.

So far, Nordstrom has announced 18 Rack openings happening in 2026, though additional units are expected to be revealed this year. With one of its direct competitors, Saks Global, now bankrupt, Saks Off 5th will be closing 57 stores, some of which Rack could potentially take over.

“There are a lot of boxes that we can go in,” said Erik, without being specific. “There have been some bankruptcies over the last couple of years that have presented some opportunities for real estate we may take advantage of. We can move pretty fast. It takes us 12 to 18 months from signing a deal to get a Rack open.”

Over the last few years, Rack’s assortment —which is mostly bought for Rack stores and not left over merchandise from the Nordstrom fleet — has been worked over to focus on carrying many of the same top brands sold at the Nordstrom full-line department stores. “A customer gets introduced to a brand in the off-price channel, ends up loving the brand and wanting a newer version of it, so they migrate over to the Nordstrom channel,” Erik observed.

“We don’t engineer that,” Pete added. “It’s kind of a natural byproduct of how it all works.”

Marking the Milestone

Nordstrom has a year-long calendar of events in the works to mark its 125th anniversary, from brand partnerships to internal moments.

“These milestones are a nice opportunity to pause a bit and reflect on the path we’re taking here,” said Erik. “For our teams, there’s pride in the history of the company. It’s a nice opportunity to recommit to how we show up for customers and how we show up for each other.”

The milestone, said Pete, is a moment to “celebrate, internally, at least, the culture of the company and what has enabled [it] to be what it is, where it can go, and the people here that all have a hand in that. That’s a fun thing to do, as we look back on some of the things we’ve accomplished. And then it’s those evergreen values and culture that enable us to continue to move on.”

That desire to keep moving could also mean new Nordstrom department stores in the future, especially as the U.S. department store sector undergoes tremendous change.

With the Saks Global bankruptcy, for instance, eight Saks Fifth Avenue stores and one Neiman Marcus store will close this season, though there could be more closures down the road. Saks Global closing stores could create some appealing opportunities for Nordstrom. And there’s room for growth, though the retailer reviewed its own store fleet amid the COVID pandemic and closed 16 full-line department stores in the U.S., and in 2023 shuttered six Nordstrom department stores in Canada.

“There’s nothing planned right now. But there are a handful of locations that, if the right physical space came up, we’d be interested. We would be opportunistic,” Erik said.