China and the U.S. will be the twin engines behind a recovery in luxury watch sales this year, while Gen Z history buffs will help drive the secondary market, according to industry experts.

While fine jewelry has been on a growth trajectory, in terms of prices and sales, watches have been trending downward, buffeted by a variety of factors, including the soaring price of gold, U.S. tariffs and tepid demand from still-cautious Chinese consumers.

But some argue the winds are about to turn. Chinese consumer sentiment is beginning to bounce back, with the country targeting 5 percent growth this year, while U.S. customers remain passionate about purchasing and collecting new and pre-owned luxury timepieces.

You May Also Like

Jon Cox, head of Swiss equities and European consumer equities at Kepler Chevreux, believes watch exports will recover in 2026, and he’s expecting the overall market for Swiss watches to grow in the low- to midsingle digits, driven by the high end.

That growth, he said, will be boosted partly by a recovery in China, where watchmakers “have typically had a greater share of luxury wallet compared with other categories.”

Cox believes there will be growth in the U.S., “provided we do not see an equity market sell-off. Wealth effects are the driver of the U.S. luxury market outperformance, so I assume it will be positive for watches overall in 2026, although there may be some early-year volatility.”

Oliver R. Müller, watch adviser, analyst and founder of consulting firm LuxeConsult, also foresees growth in the U.S., but is cautious in his outlook.

He said that despite the massive tariffs introduced last August, sales to U.S. high end-consumers never went down. “The anticipated price increases even helped to push sales as clients took advantage of the existing lower prices. I expect the U.S. market to continue to grow, but at a reduced pace compared with the last four years post-COVID[-19], which saw the U.S. market become the largest market for Swiss-made watches,” he said.

Now that the situation has stabilized, with tariffs on Swiss exports down to 15 percent from 39 percent, “clients will be more confident, but the paradox is that they will be in less of a hurry to buy,” Müller said. “I expect sales to be flattish, but on a high comparison basis, which should result in a good year, although there will be a marginal — if any — sales increase year-on-year.”

Müller isn’t expecting any further price increases in 2026 due to the strong Swiss franc and soaring gold prices, which hit a new high of more than $4,500 an ounce on Dec. 24. They are expected to rise further in 2026, although they have slipped back slightly to about $4,890 as of Tuesday.

He also said that, due to the earlier U.S. tariffs of 39 percent, retail prices for some Swiss brands have already risen 12 to 14 percent. One of the outliers is Rolex, which revealed another round of price increases, effective Jan. 1. Rolex prices are up 2 to 6 percent on average, with gold models rising the most.

Eugene Tutunikov, chief executive officer of pre-owned luxury watch retailer SwissWatchExpo, said that in the secondary market prices should remain flat, “unless there’s some kind of event that disrupts production, or if tariffs are increased again, which I don’t think they will be.”

Tutunikov, whose business is based in Atlanta, believes “a lot will depend on what the financial markets do. Our stock markets are still, more or less, on record highs, and a lot of people have had a lot of gains in their 401(k) and retirement plans. So they’re feeling bullish. If the stock market stays high, I think we’re going to have a very good year.”

In terms of trends, Tutunikov said he’s seeing “very, very strong demand across the board, from younger consumers” between 20 and 30 years old. “I think that demand is only going to accelerate, and it’s going to be a significant driver of the pre-owned watch market,” he said.

Müller said the younger demographic is particularly interested in heritage brands and historic styles.

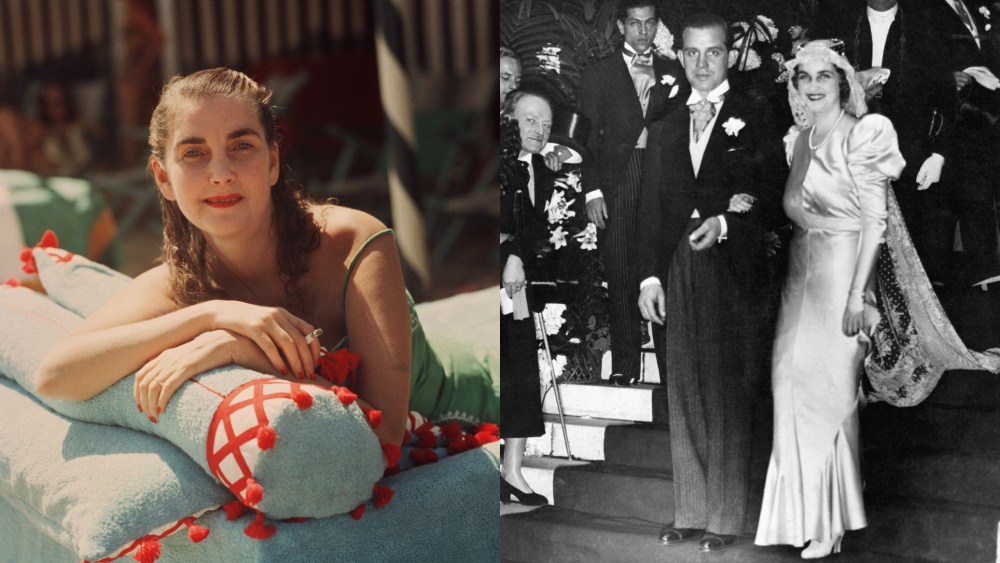

“Young clients are discovering Cartier’s oldest product icons, and that has helped push the prices on the secondary market for vintage Cartier watches,” he said.

“It’s very interesting to note that Gen Z are very often described as having different buying patterns compared with middle-aged people, but they are in fact buying watches from the past,” he said, adding that younger customers are looking for colorful dials and 1970s and 1980s vintage styles in particular.

In response to that demand, brands have been “grooming icons and reviving forgotten” styles, rather than splashing out on new product initiatives.

Müller believes the “champion” brands — Rolex, Audemars Piguet, Patek Philippe, Richard Mille and Cartier — will continue to gain momentum this year. “They are managing to grow, or at least remain flattish in terms of sales, by wielding their pricing power, a consequence of their strong brand equity and desirability,” he said.