2023 marked some major milestones for Coty, the largest being its dual listing in Paris. The company is expected to use the proceeds of its Paris listing, which went ahead in September, to pay off outstanding debt and for investments and capital expenditure.

In July, Coty had announced plans to sell a 3.6% stake in Wella to investment firm IGF Wealth Management in a further move to pay down debt. In November, it transpired that the deal had not materialized because the two parties were not aligned on deal terms. Coty has nevertheless reiterated its commitment to divest its remaining 25.9% stake in Wella by 2025.

There was also the debut of a campaign spearheaded by CEO Sue Y. Nabi to “undefine” beauty, aimed at changing definitions of beauty. Nabi wrote an open letter to major dictionary publishers, cosigned by the company’s executive committee and senior leadership, highlighting what they see as outdated definitions of what beauty means.

Related Articles

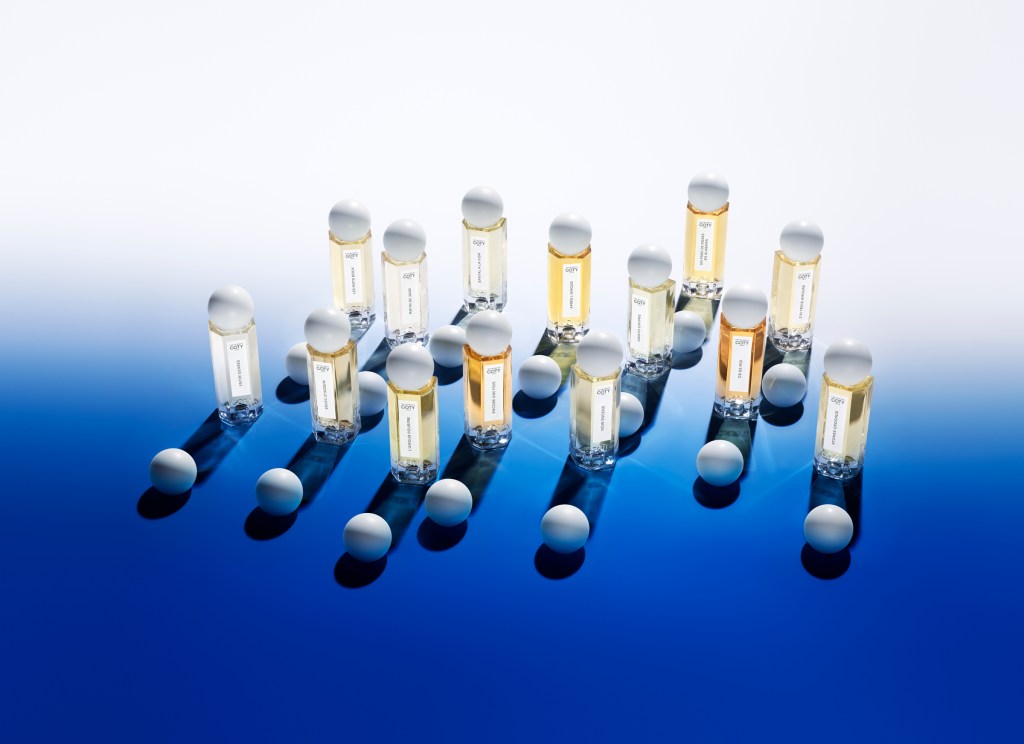

Coty continued to diversify its portfolio, meanwhile. While mainstream prestige fragrance still represents a significant proportion of Coty’s business, the company is leaning increasingly into skin care and high-end fragrance. It unveiled a new strategy for the ultra-premium segment of the market, dubbed “Coty Protopia,” to be pioneered by the launch of niche fragrance brand Infiniment Coty Paris in 2024 and Orveda’s new Omnipotent Concentrate serum, which launched in August.

This followed the introduction of Lancaster’s Ligne Princière, an ultra-premium line inspired by products formulated for Princess Grace of Monaco and her family in the ‘60s. The range debuted last March in China and is seen as key to helping the company grow its presence there, as well as in skin care overall. Other initiatives last year included the relaunch of Philosophy.

Further key changes included extending its license with Marc Jacobs with the development of a Marc Jacobs prestige beauty line, which will be ready in roughly two to three years. Coty also extended licenses with Jil Sander, Davidoff, Mexx, Bruno Banani and Adidas, and inked new licensing agreements with Marni and Etro.

Speculation continued that Kim Kardashian and Kylie Jenner are in talks with Coty to buy back their respective brands, but at press time, they remained part of the portfolio.

As to its performance in 2023, Coty’s prestige division saw sales jump 18.5% on a like-for-like basis, buoyed by fragrance. Burberry Goddess Eau de Parfum was the number-one women’s fragrance launch in pivotal markets and propelled Burberry to become a Top 10 fragrance brand in North America and Europe. In the premium fragrance category, Gucci’s The Alchemist’s Garden, Burberry Signature and, especially, Chloé’s Atelier des Fleurs have been contributing to growth.

The Consumer Beauty division performed strongly, with a 9.2% increase in like-for-like sales, spread across cosmetics, fragrances, and skin and body care categories.

On the personnel front, Priya Srinivasan was named chief people and purpose officer, Caroline Andreotti was appointed chief commercial officer, prestige and former Meta and Google executive Pierric Duthoit was tapped as chief digital officer, all during 2023.