Amer Sports Inc. is showing no signs of slowing down.

The parent of Salomon footwear and Arc’teryx posted third quarter earnings results on Tuesday, and investors liked what they saw, sending shares of Amer Sports up 10.4 percent to $33.89 in pre-market trading.

Net income for the three months ended Sept. 30 was $143.1 million, or 25 cents a diluted share, versus net income of $55.8 million, 11 cents, in the year-ago quarter. Revenue rose 29.7 percent to $1.76 billion from $1.35 billion.

You May Also Like

For the nine months, net income was $295.9 million, or 53 cents a diluted share, from net income of $57.2 million, or 12 cents a year ago. Revenue rose 25.9 percent to $4.47 billion from $3.55 billion.

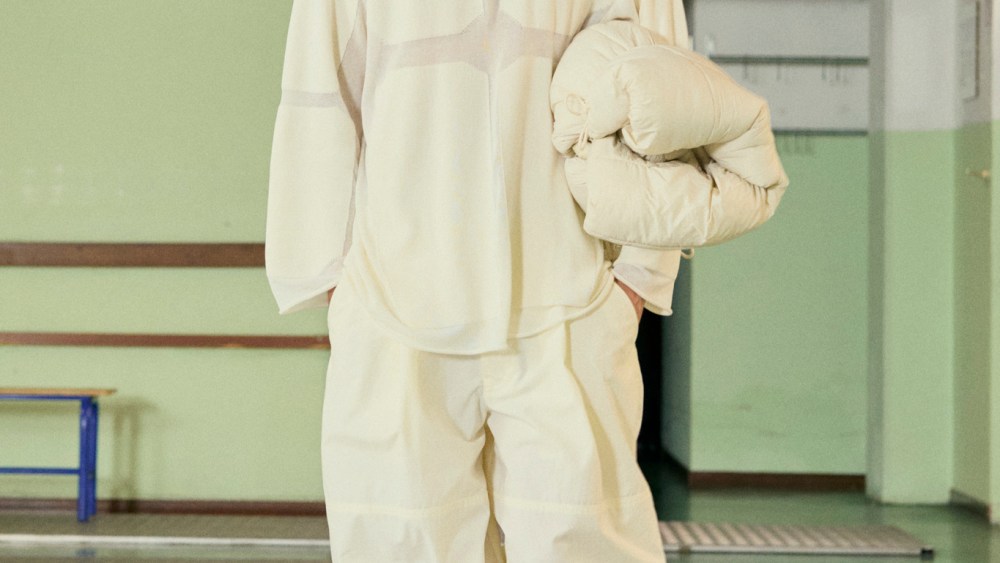

“Amer Sports’ strong momentum continued in the third quarter, as our unique portfolio of premium technical brands continues to create white space and take share in sports and outdoor markets around the world,” Amer’s CEO James Zheng said. “All three segments performed extremely well led by exceptional Salomon footwear growth, an Arc’teryx omni-comp re-acceleration, and solid growth from Wilson Tennis 360 and our Winter Sports Equipment franchises.”

Zheng said the company believes its specialized, highly technical brands are “well positioned within the premium sports and outdoor market,” adding that the sector continues to be “one of the healthiest segments across the global consumer landscape.”

“Salomon footwear continues to add a strong second leg of profitable growth to Arc’teryx’s already exceptional trajectory, significantly elevating the financial profile and long-term value creation potential of the Amer Sports portfolio,” the company’s CFO Andrew Page said.

Page noted when the company posted second quarter results that Arc’teryx footwear is “growing faster than” the brand itself.

Looking ahead, he said the company expects to deliver “2026 Group revenue growth towards the high-end of our long-term algorithm of low double-digit to mid-teens annual sales growth.”

The company raise guidance for the year ending Dec. 31, 2025. The guidance presumes that the current tariff rates on all countries will stay in place for the remainder of 2025 and beyond.

Amer is forecasting revenue growth of 23 percent to 24 percent, with gross margin of 58 percent and operating margin between 12.5 percent and 12.7 percent. Diluted earnings per share was guided to a range of 88 cents to 92 cents.

The company held its first Investor Day in September since it completed its initial public offering, telling investors that it has a $5 billion revenue target for Arc’teryx by 2030.