For the past few years, skin care has dominated the beauty M&A scene, but this year could be different.

After struggling amid the global coronavirus pandemic, the color cosmetics category has finally rebounded as consumers returned to offices and started going out again. Innovation in the category combined with clean formulas has helped immensely, driving sales to pre-pandemic levels.

Now, that booming activity looks likely to translate into M&A moves, especially in the specialty color cosmetics category.

“Last year was the first year where we really witnessed a new growth of color, and investment decisions are not made in a vacuum. They’re driven by actual trends,” said investment banker Ariel Ohana of Ohana & Co.

Related Articles

“This new class of brands has all been funded in the last two to four years. Investors typically like to hold between three to five years and they’d like to exit when the market is trending favorably for their business.”

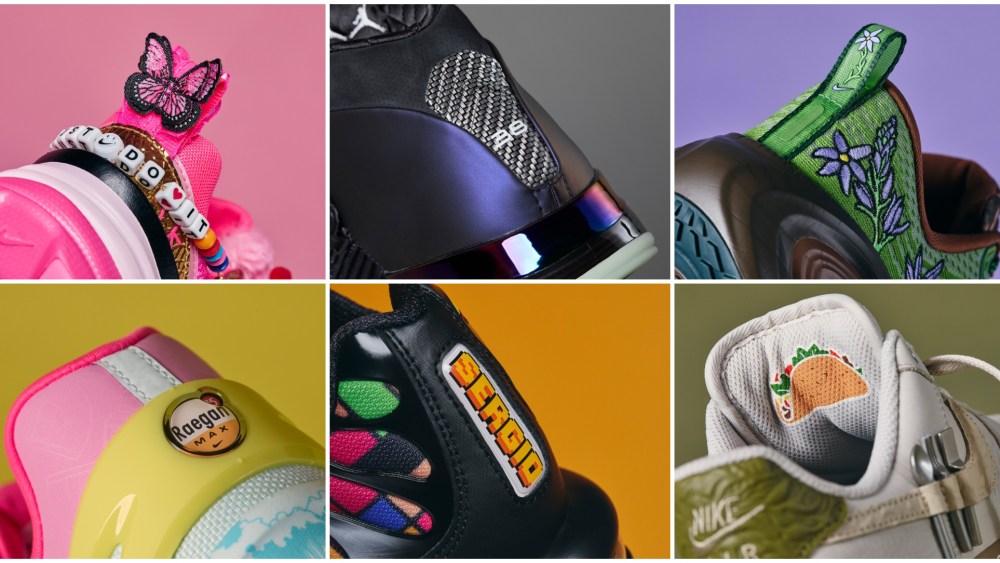

Just look at Kosas Cosmetics, the Los Angeles-based makeup brand founded by Sheena Zadeh-Daly in 2015 that was an early entrant in the clean cosmetics category. WWD reported in January it hired investment bank North Point to explore sale options, according to industry sources.

Other brands that could be ripe for acquisition in 2024 include Merit, Makeup by Mario, Saie, Milani and Tower 28. Westman Atelier and Selena Gomez’s juggernaut Rare Beauty are also in the mix, but sources believe these are more likely 2025 targets.

At the same time, TSG Consumer Partners is rumored to be mulling an exit from Huda Beauty, of which it acquired a minority stake during 2017.

As successful as many of these players are, though, insiders are asking if there are enough potential homes for all of these brands and who are the likely bidders?

The answer appears to be “yes,” but some buyers won’t be the traditional players.

Private equity is becoming increasingly active in the beauty space. In the last year alone, Yellow Wood Partners acquired both Suave North America and the Elida portfolio from Unilever, as well as ChapStick from Haleon. And it hasn’t been shy about the fact that it is looking for more brands to add to its roster.

In 2021, Advent-backed Orveon acquired Laura Mercier, Buxom and Bare Minerals from Shiseido. It had been on the lookout for skin care targets, but with a new CEO at its helm, its strategy for this year is unclear.

International players are also becoming more interested. “There are two new categories of strategics that you also might find active in 2024,” Ohana said. “Asian strategics, because in recent years they have become more M&A savvy, and the luxury goods strategics, who now consider beauty as a high priority investment area.”

Gucci owner Kering, for one, is actively bolstering its beauty division, last year adding high-end luxury fragrance house Creed and reviewing its licensing deals. In Asia, while beauty giant Shiseido has said it is focused on skin care for now, other strategics in Japan, Korea and China are actively looking for assets and could be open to color cosmetics, sources said.

Elsewhere, E.l.f. has said it’s open to more acquisitions following its purchase of masstige skin care brand Naturim.

All this, though, doesn’t mean that the traditional homes for beauty brands like The Estée Lauder Cos. and L’Oréal aren’t in the mix. “They’re always looking,” said one source.

Two of Lauder’s California brands — Too Faced and Smashbox — have been struggling as has the wider company, with speculation continuing that it could divest underperforming assets, something the company has denied. Nevertheless, multiple sources told Beauty Inc that it would be a good fit for Westman Atelier.

Of acquiring color cosmetics brands, Kelly McPhilliamy, managing director of Harris Williams, said: “It’s an opportunity for strategics not only to widen their portfolios, but to age them down and to acquire capabilities, and there’s some really incredible brands out there that are doing all of those things. That should attract very good interest.”

But with all these possibilities, many of the players will be watching what happens to the first company to sell.

Maggie Wilmouth, vice president of consumer and retail at William Blair, said: “A lot of them are saying that if Kosas is maybe the first one to go, the home that brand finds could be an indicator to how the market could play out the rest of the year.”

McPhilliamy added: “It’s going to be interesting to watch the chessboard and see which one is acquired first and what that means for the second, third and fourth and fifth one. This will certainly be an interesting year to see who’s trying to get out ahead versus waiting to see where things land, where the interest lies. There’ll be a lot to pay attention to.”